-

Quest for Friction Less Experiences

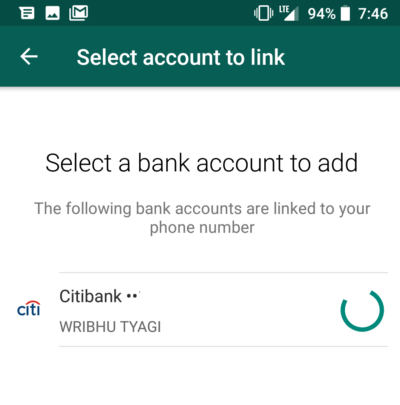

Yesterday, I got to experience the WhatsApp payment flows. It surely felt like a neat friction-less experience both for adding/mapping bank accounts and for in-chat payments. And in my excitement I forwarded it to a friend who didn’t have any UPI handle so far. And I was surprised by the reaction. How does WhatsApp know…

-

Why so serious ! Need for humor at work

This happened yesterday – We settled down for a discussion first thing in the morning and a colleague says- smile guys, its a good day! But, it was a spirited discussion . And the smiles quickly vanished. We shared our views and debated. And I realised I was talking with a lot of emotional energy. I told myself,…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…

-

Cash is not the enemy – Stickiness of Cash Part 1

Why is cash so sticky in our society? Many of us have argued for the need to build convenience, security and ubiquity for digital payments. And then cash would start receding. No debate there. But we forget that as individuals our brains are wired to go back to cues that are triggered at the sub-conscious…

-

Beyond Big Data – A Small and fast data example

Big Data is all the rage. Everywhere you go, any meeting or presentation one sits through, Big Data seems to be there. But there are opportunities beyond big data. E.g. how we handle small data fast. Here’s an example of small data that I experience almost everyday. In many corporate buildings in India, you would…

-

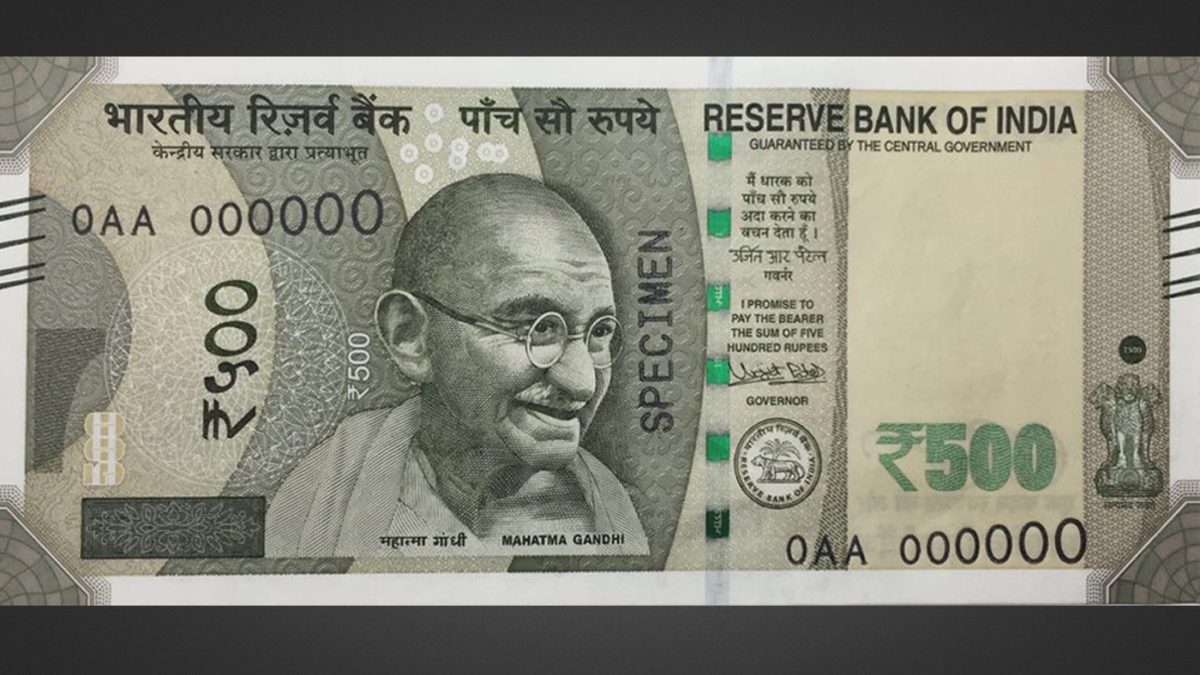

Immediate reactions to the banning of Rs 500 & 1000 notes

As Anshul & I sat listening to the PMs announcement and then all the experts on CNBC, we couldnt help discussing what all must be happening around the country in the next 72 hours. We are surely living in interesting times. Managing high denomination notes: All secret saving places in the homes/offices/godowns will be cleaned…

-

Good rules should be designed for higher adoption

How do we drive adoption for rules in a community, or even at a country level ? Should a good rule be designed to make it easily enforceable too? I think it should be. If we want to build a society where most follow the rules, enforceability should be an important criteria. To decide whether…

-

Search Vs Social – the long tail of ad revenues

Google and Facebook together took away 64% of the total US online advertising spends. And Facebook had around 65% of the overall online display ad-spends. These are incredible levels of consolidation in the ad spends among the leaders. Enough has been said and discussed about the challenges Google is facing and how mobile ad revenues…

-

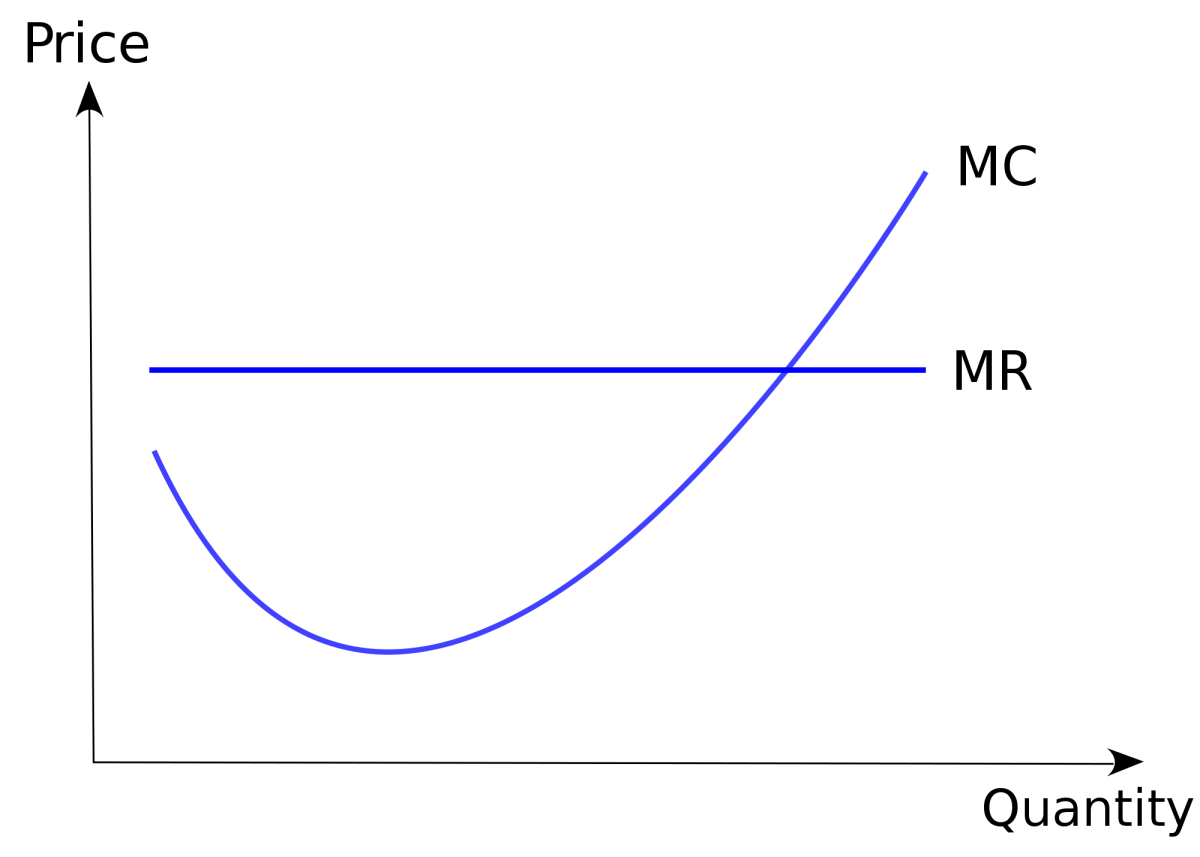

Unit Economics in the times of Auction Marketing Models

Unit Economics is all we hear these days in the consumer technology world. Unfortunately for many start-ups seeking venture funds, this is the biggest hurdle they need to cross to build a strong case for their business. What is the concept of Unit Economics I will not go into the definition and relevance of Unit…

-

Public policy, ripple effects and feedback loops

I have always been intrigued by product design and by extension policy design (& implementation). If the government were to look at itself as a start-up technology venture, the policies, schemes and guidelines issued by the government would possibly be the “products” of this venture. And like any good product manager, one should study not…

-

Payments are a critical piece – Digital Banking ToolKit

In India, digital and mobile Payments is a really HOT space right now. HDFC Bank introduced PayZapp which intends to be the gateway for all m-commerce transactions, with incremental offers as the initial incentive ICICI bank introduced “Pockets” – a way for even non-ICICI Bank customers to have access to mobile payments Axis bank launched…

-

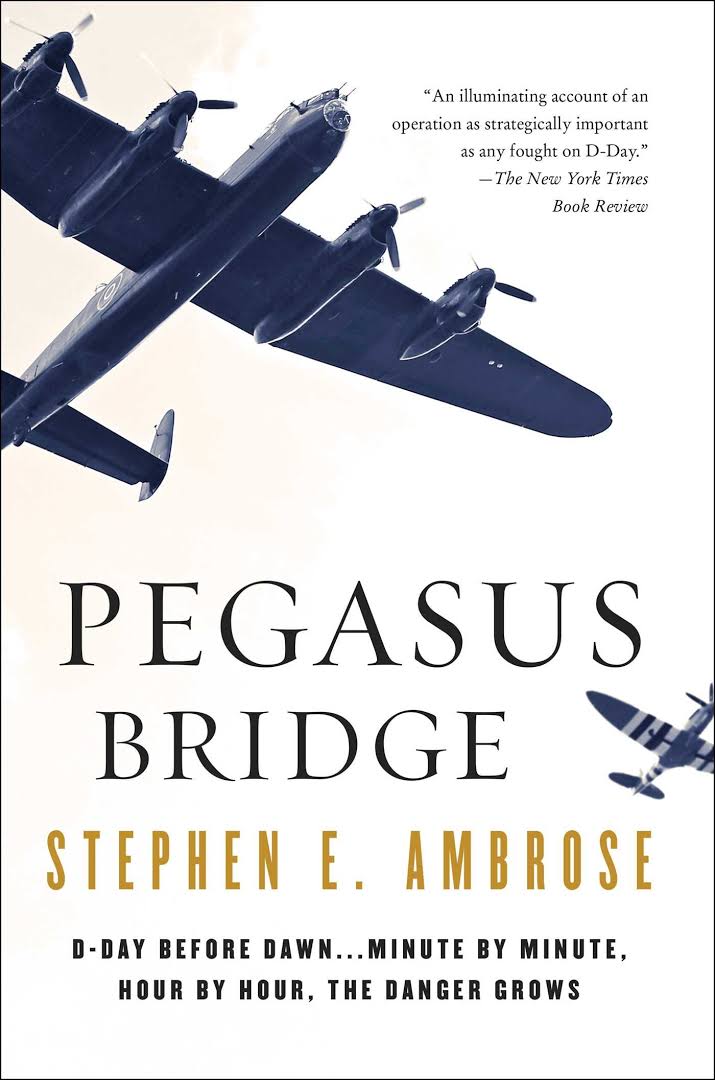

Marshmallow Test and Insurance Marketing

I spent the last week reading up “The Marshmallow Test by Walter Mischel”. And while the book is a fascinating summary of key findings (and some of its applications) from Walters more than three decades of research, I found some of it is relevant for how we look at Insurance Marketing and Sales. What is…

-

Showing Contact Addresses in Google Maps

Quick Summary: Here’s a small product feature recommendation for Google Maps on Android. Currently when I am in Google Maps and typing in the search box, it throws results that match with Google Places directory on the web. If it also throws matches with local contacts in the phone (or Google account) that have an…

-

Thin Mobile App or a Fat one – Digital banking toolkit

Mobile is the new frontier and banks know this well. Amongst the various choices to make as part of the bank’s overall mobile initiative, is the decision around the structuring of mobile app(s). Thin App Vs a Fat App. These might sound strange terms especially in reference to mobile apps and no, we are not…

-

SMS is reborn as an acqui channel in the Smartphone age

In the early days of Deal4Loans, we used to get a lot of traffic and leads through SMS campaigns. Especially for products like Personal Loans (Simple pitch and high-urgency in a need based product) During those days, NDNC (National DO NOT CALL) list was not introduced and there were very few players who were sending…

-

3 tips for New To Bank Acquisitions – Digital Banking Toolkit

Why Online Acquisitions Acquiring New To Bank (NTB) customers is a key agenda for most Digital Heads at Banks. Its only logical that online acquisition budgets are getting bigger, given the following: Consumers are spending more and more time online. Digital is the best channel to start a dialogue Digital channels are tracked exhaustively. You…

-

Easier to be Krishna than to be Arjun

The other day, my mom shared a powerful and thought-provoking quote, that she had just read. It’s easier to be Krishna, than to be Arjun !! And she went on to explain, that being Krishna requires one to look inside and discover the highest qualities that each of us are bestowed with. But to be…

-

Uber and Free Market Economics

Uber has changed the way we travel within cities. On a recent trip to Jaipur, the first thing I did on reaching the city, was to top-up my PayTm wallet to get going on Uber. (yeah no card-on-file yet 🙂 ) And over the next 3 days I took more than 12 rides across the…