Category: Financial Services

-

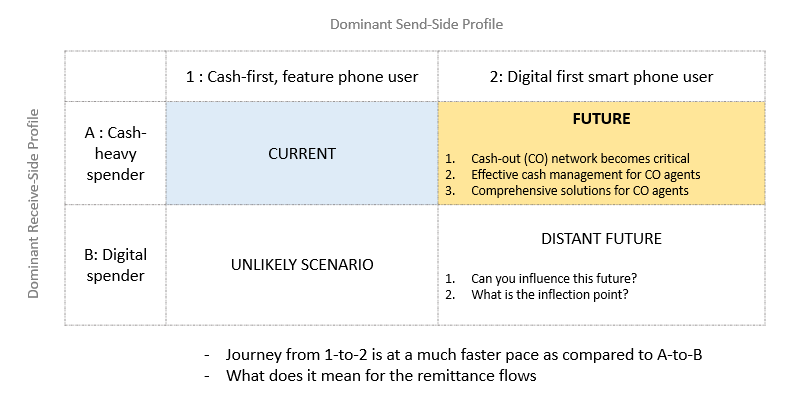

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

A tale of two cards

“Building a visionary company requires one percent vision and 99 percent alignment.” —Jim Collins and Jerry Porras, Built to Last And I believe the alignment needs to show not in meetings but on the ground – in customer interactions, in every process and the decision making across all levels. A recent experience drove home the point very…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…

-

Immediate reactions to the banning of Rs 500 & 1000 notes

As Anshul & I sat listening to the PMs announcement and then all the experts on CNBC, we couldnt help discussing what all must be happening around the country in the next 72 hours. We are surely living in interesting times. Managing high denomination notes: All secret saving places in the homes/offices/godowns will be cleaned…

-

Payments are a critical piece – Digital Banking ToolKit

In India, digital and mobile Payments is a really HOT space right now. HDFC Bank introduced PayZapp which intends to be the gateway for all m-commerce transactions, with incremental offers as the initial incentive ICICI bank introduced “Pockets” – a way for even non-ICICI Bank customers to have access to mobile payments Axis bank launched…

-

Marshmallow Test and Insurance Marketing

I spent the last week reading up “The Marshmallow Test by Walter Mischel”. And while the book is a fascinating summary of key findings (and some of its applications) from Walters more than three decades of research, I found some of it is relevant for how we look at Insurance Marketing and Sales. What is…

-

Thin Mobile App or a Fat one – Digital banking toolkit

Mobile is the new frontier and banks know this well. Amongst the various choices to make as part of the bank’s overall mobile initiative, is the decision around the structuring of mobile app(s). Thin App Vs a Fat App. These might sound strange terms especially in reference to mobile apps and no, we are not…

-

3 tips for New To Bank Acquisitions – Digital Banking Toolkit

Why Online Acquisitions Acquiring New To Bank (NTB) customers is a key agenda for most Digital Heads at Banks. Its only logical that online acquisition budgets are getting bigger, given the following: Consumers are spending more and more time online. Digital is the best channel to start a dialogue Digital channels are tracked exhaustively. You…

-

Digital India – its already here

Today’s the launch of the Digital India initiative and quite a coincidence that I had an experience which makes me believe that Digital India is already here. Here’s what happened. I was in Mumbai and called for an Uber. I started talking to the cabbie to understand the target market for a specific use case…

-

Play to your strengths – Digital Banking Toolkit

Nadal is the king of clay. Given a choice of surface, I guess he would choose clay 9 out of 10. We all get it – one should play to one’s own strength. Its obvious in sports, but most of us fail to apply the same rule(s) in business. As most banks embrace digital, this…

-

Why is Financial Inclusion important?

Financial Inclusion is a common theme across multiple initiatives both by governments and private sectors across economies. Especially in the developing world, it would be safe to say that Financial Inclusion must be in the top 5 priorities of the respective governments. But why exactly is Financial Inclusion important ? Financial Inclusion takes an…

-

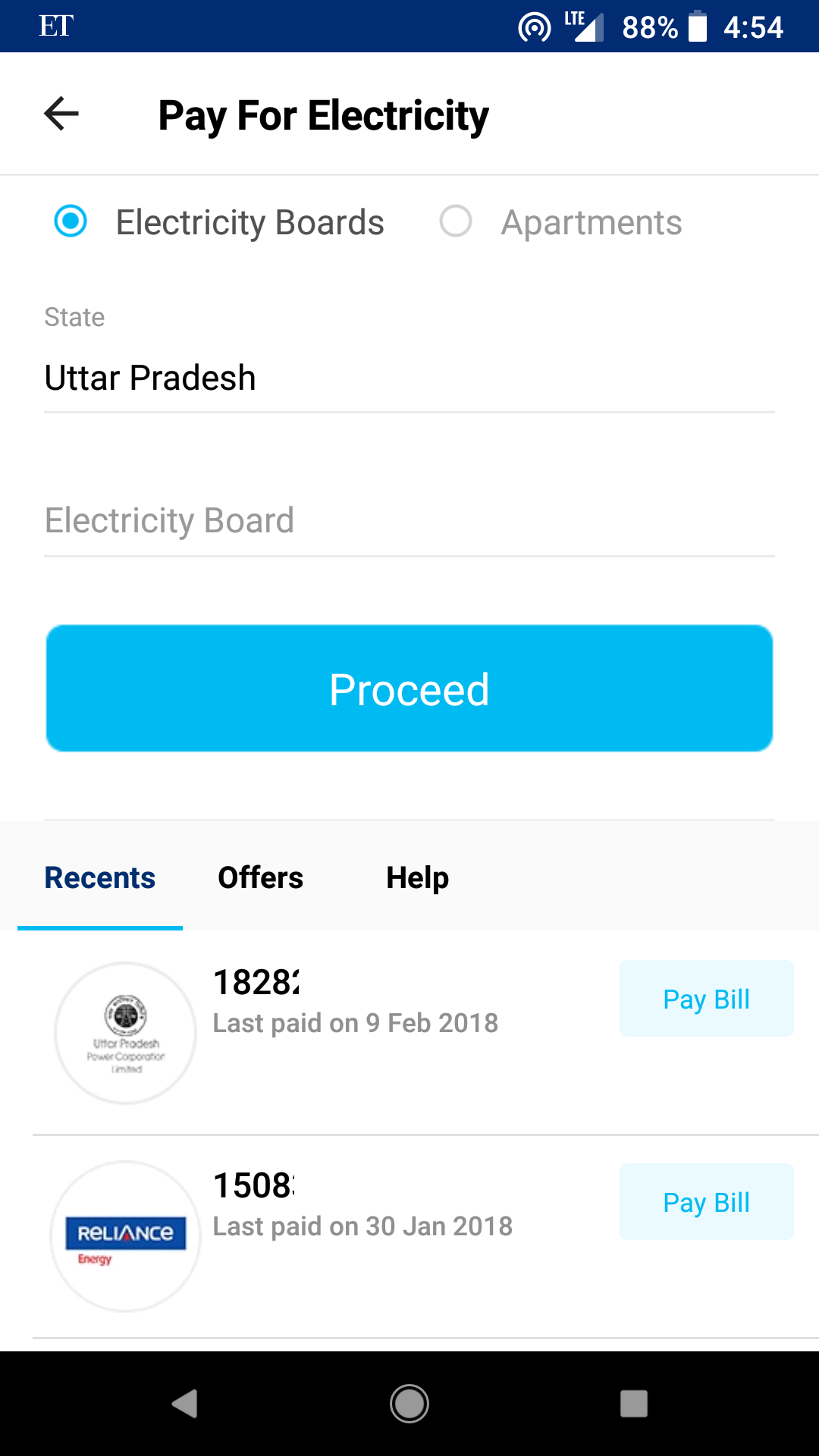

Why I use Paytm for all bill payments except Airtel

Consumer behavior used to be a course that marketing folks took in 2nd year of Bschool. I stayed away , like most other marketing courses. But over the years, time and again I have seen the importance of understanding the consumer behavior – why do consumers behave a specific way, why and how are habits formed,…

-

Are commission based channels low on trust

In US car salesmen are amongst the least trusted professionals. On digging deeper one finds that they share these low rankings with advertising professionals, stockbrokers, insurance salesmen and surprisingly politicans too (Members of Congress, Senators and Governors). Have a look at the Gallup report summary below: While there must be multiple reasons for people to…

-

Mobile Payments Security – concerns, issues, threats, models and measures

One of the biggest reason why cash has still reigned supreme for purchases is the percieved safety it brings. It limits the potential damage to the hard currency one is carrying in her wallet. For many late stage adopters of plastic payment systems, secuirty has been a concern. Same is happening right now for Mobile…