A few weeks back I was wondering what happens when we buy a car but don’t drive it. While the automobile industry witnesses a growth but is it something that increases the drag on the economy.

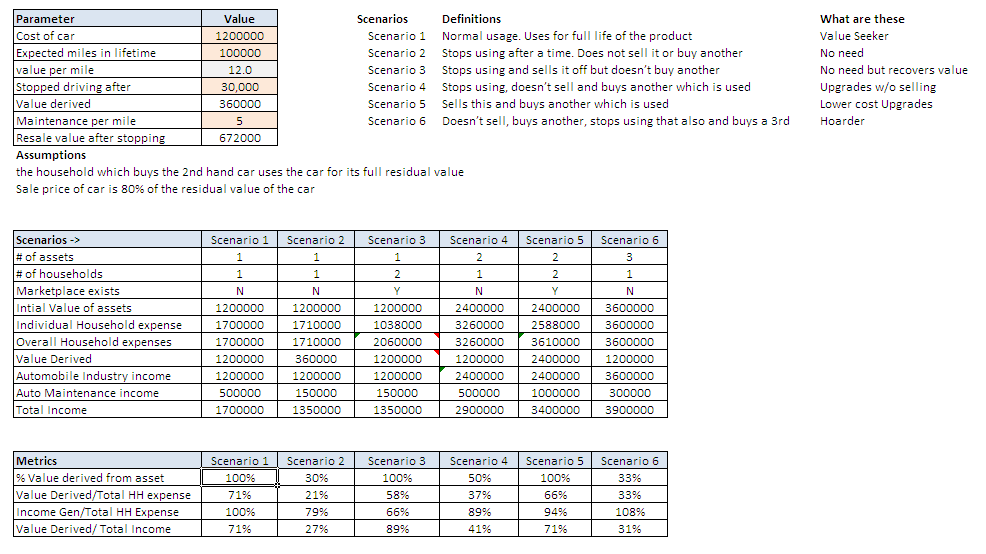

I spent a few hours to work on a very simple model to find what happens in various consumption scenarios.

Approach:

I had to create a simple-one -product economy. Hence I assumed that

- Our economy produces cars each worth Rs 12 lakhs.

- Average utility lifetime of the car as 1lakh miles

- Additional spends required based on consumption as 5 Rs per mile

I also simulated 6 different scenarios from a household’s perspective. namely:

- Scenario 1: Normal usage. Uses for full life of the product

- Scenario 2: Stops using after a time. Does not sell it or buy another

- Scenario 3: Stops using and sells it off but doesn’t buy another

- Scenario 4: Stops using, doesn’t sell and buys another which is used

- Scenario 5: Sells this and buys another which is used

- Scenario 6: Doesn’t sell, buys another, stops using that also and buys a 3rd

Once these assumptions were plugged in, I calculated a few ratios and interesting things emerged.

- The value derived from each product drastically changes between two similar scenarios where the old stuff is traded vs where it is not sold. Does this mean that in a resource constrained economy, a market place optimizes the return of invested resources through higher utilization?

- In the scenario 6, income generation is highest for every 1 Re spent by the households. So maybe hoarding is a good strategy when domestic income generation is important. On the contrary imagine if we do this in categories where we import the products – we might be supporting Chinese economy more than we ever wanted to.

Not knowing fully well what these ratios meant, I spoke to my Professor friend Dr Dash who gave some very interesting path of analysis. Essentially what he mentioned was that I should look at this top down rather than at a micro level. He also mentioned about ICOR – Incremental Capital Output Ratio – how much additional capital do we require for each unit of GDP increase. E.g. an ICOR of 3 means we need 3 Rs for every 1 Re contribution in GDP.

- Assume a market size of 75 Bn USD and lets say one third of this is from private cars. Hence a market of 25 Bn USD

- Now assume that 5% of all cars produced in a year lie idle, which means about 1.25 Bn USD worth of cars remain idle. (and this is incremental value of locked capital every year)

- So with an ICOR of 5 , these un-utilized cars translate into 6.25 Bn USD worth of capital that is “wasted” every year.

- But where it became tricky for me was that whether the asset is utilized or not, the GDP is impacted depending on ICOR. So is this a case of smarter capital allocation? Would this “wasted capital” helped us in producing some other more needed product or service?

- A very interesting and probably extreme case of this top-down analysis would be the scenario where the asset is imported. In such a case, a reduction in “wasted capital” would result in better trade-balance

- With a marketplace, if 40% of these cars are sold in the second-hand market, then we free up that much capital.

- Moreover with cars available at a lower price, many category shifts might happen. E.g. say a Maruti Alto being sold in the second hand market might attract a person who was in the market for a 2 wheeler earlier.

Leave a Reply