Category: Mobile Payments

-

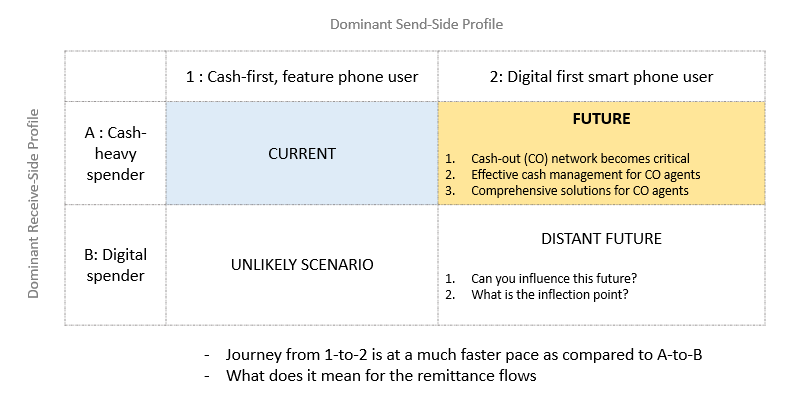

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

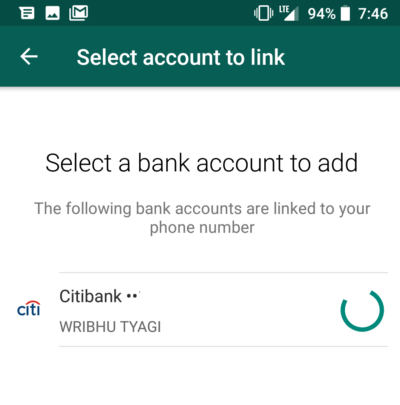

Quest for Friction Less Experiences

Yesterday, I got to experience the WhatsApp payment flows. It surely felt like a neat friction-less experience both for adding/mapping bank accounts and for in-chat payments. And in my excitement I forwarded it to a friend who didn’t have any UPI handle so far. And I was surprised by the reaction. How does WhatsApp know…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…

-

Thin Mobile App or a Fat one – Digital banking toolkit

Mobile is the new frontier and banks know this well. Amongst the various choices to make as part of the bank’s overall mobile initiative, is the decision around the structuring of mobile app(s). Thin App Vs a Fat App. These might sound strange terms especially in reference to mobile apps and no, we are not…

-

Why mobile payments must arrive soon

I try to go walking on most weekdays. And I prefer to do so light – carry just the minimal stuff. On my way out for a walk yesterday, I stopped by to take some cash along with me – just in case. And this got me thinking, with my smartphone (& earphones) I do not…

-

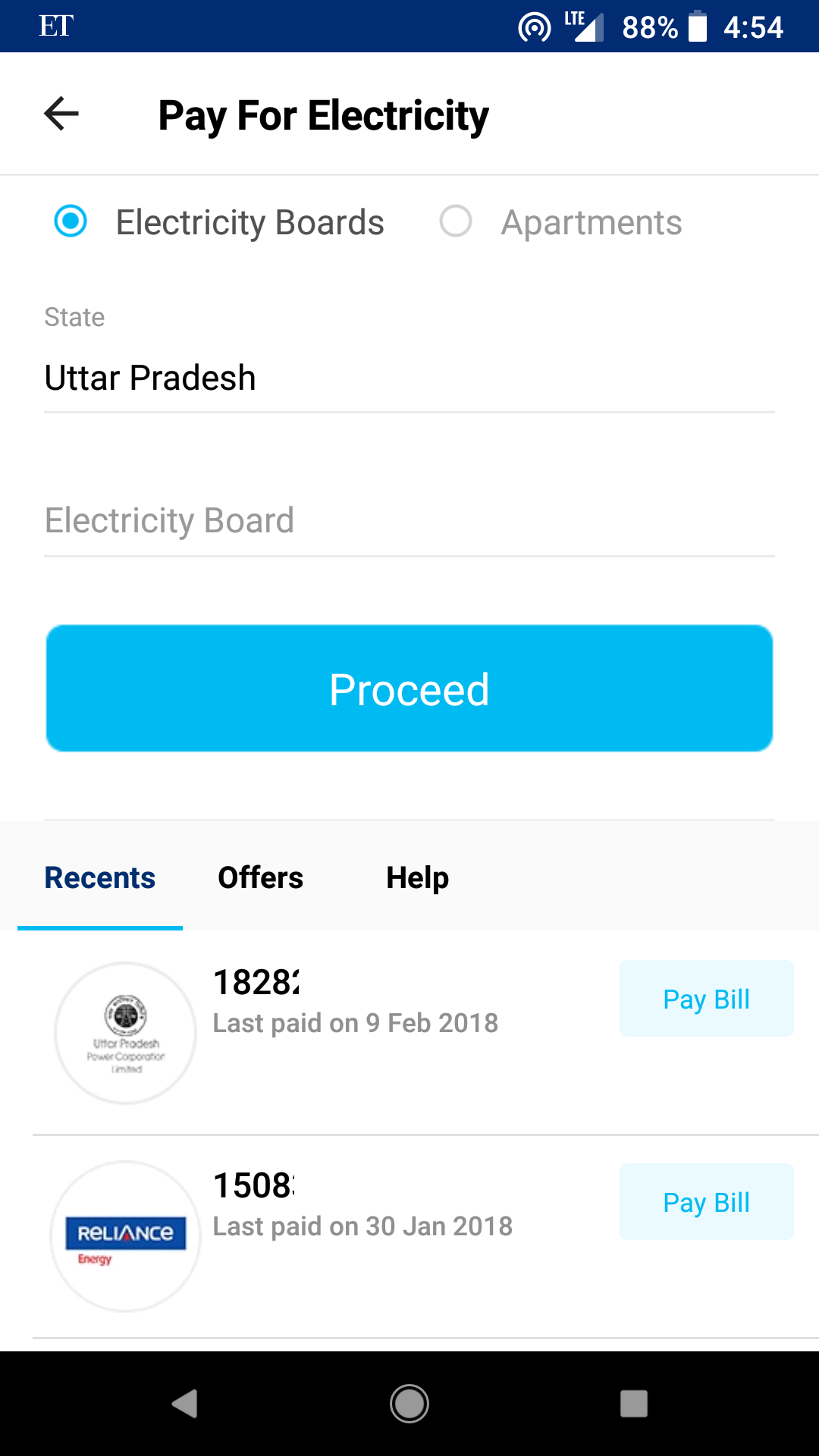

Why I use Paytm for all bill payments except Airtel

Consumer behavior used to be a course that marketing folks took in 2nd year of Bschool. I stayed away , like most other marketing courses. But over the years, time and again I have seen the importance of understanding the consumer behavior – why do consumers behave a specific way, why and how are habits formed,…

-

Basics of Mobile Payments

Understanding the basics of Mobile Payments required me to find answers to these questions. What is a mobile payment What are the formats/models of mobile payment What is the infrastructure required for mobile payment Are mobile payments secure? What are the security measures adopted?

-

M PESA story

What are the things M PESA did right? Clean and focused campaign – “Send Money Home” – focused only on national remittances – something that was done in abundance Transaction fees were the lowest for any mode of money transfer Fees clearly communicated with slabs/displays at agents Differential pricing for customers paying to other customers…

-

Consumer pitches for payment solutions

Any new payment solution seeks to change the consumer behavior in a significant way and hence tries to ride on one or multiple triggers. These triggers are the reasons why a consumer would prefer our payment option over all the others at the moment-of-truth. I do not want to carry cash/cards/bulky wallet This feels really…