Author: Wribhu

-

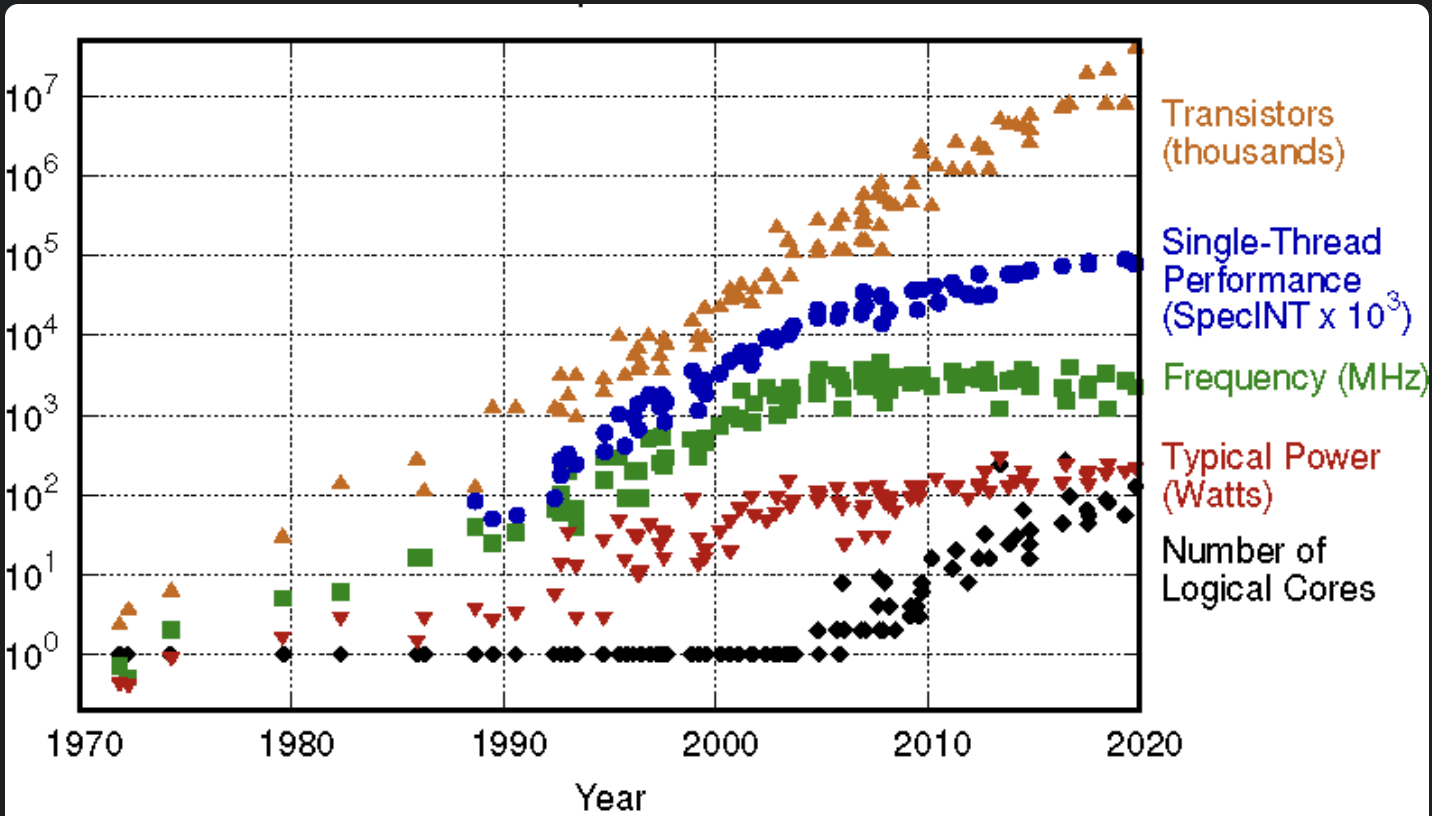

Will there be a Moore’s Law for GenAI

The world got rattled a few days back with the DeepSeek release of its latest model and how they have managed high performing models with significantly low compute requirements. The stock markets noticed, tech pundits have been having a field day on Linkedin and X. But what if this is not a one-off and we…

-

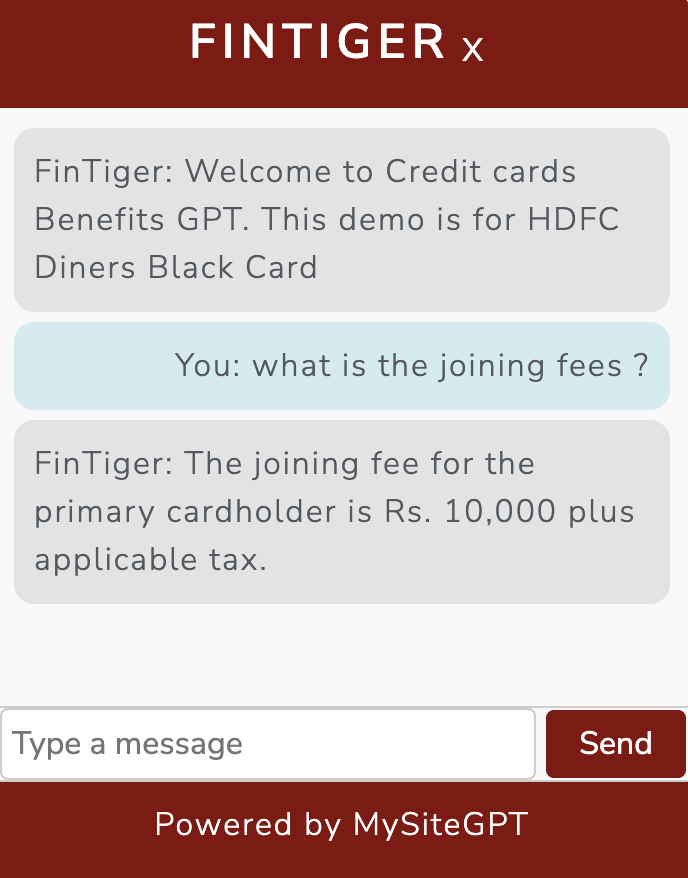

Building own RAG AI

In my journey to understand genAI better, spent a good part of last 5-6 weeks building a RAG AI chatbot platform. And what an amazing 1.5 months its been ! Quite a few false starts esp when I built it end-to-end using the OpenAI vectorStore + Assistants + FileSearch + Threads. The lag was so…

-

GenAI + Customer Service/Experience

GenAI for Customer Service is an obvious opportunity in 2024. In the Predictive vs Generative AI, the leapfrog has been the machine’s ability to understand commonly used human language. And for any enterprise one of the biggest source of incoming natural language data is customer communications. I have been tinkering with OpenAI APIs to give…

-

Filter by Scale, Sort by Velocity – Building Momentum

For most organizations (startup or otherwise) building momentum might be the #1 goal. Increasing momentum on revenues, margins, customers, transactions, data-footprint etc etc. A big part of it comes down to choosing which opportunities to go after and which one’s to drop (even if for now). Of course there are multiple other factors too –…

-

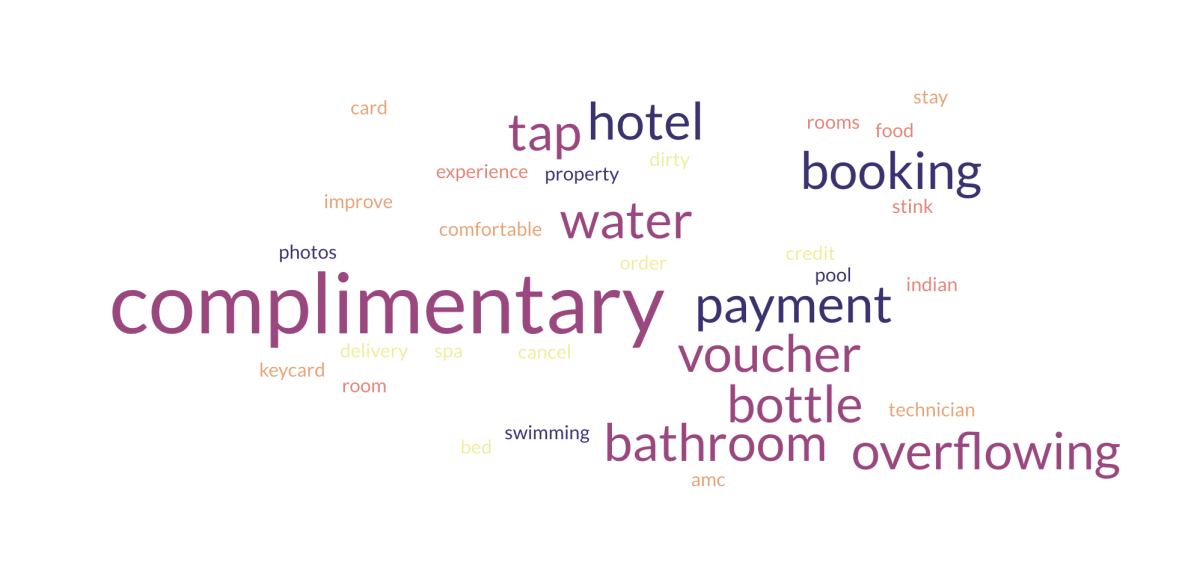

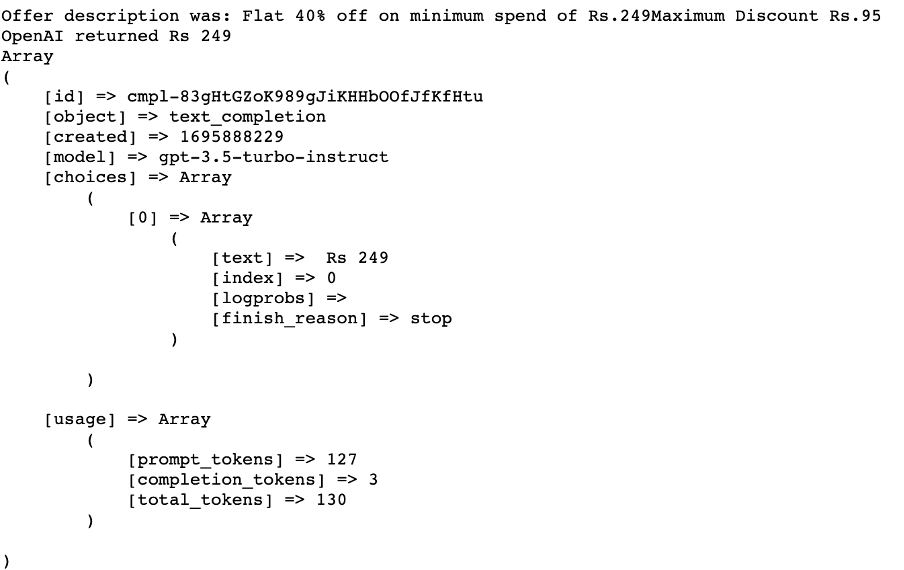

Using GenAI APIs to extract information from text

Spent half a day tinkering with GenAI (OpenAI) APIs to solve a real-world problem. Felt good to be coding after so many months. This was the 2nd attempt at understanding GenAI better with a real world problem statement. First one was this. The Problem Statement – Opportunity to deploy OpenAI At mTuzo we have collated…

-

Game Theory, No-Regret Plans and the role of Iceland in World War II

Game Theory and understanding options available Game theory provides a strong framework for strategic options in a dual player game. Options available both to self and the other player(s). E.g. When you are in a war. What would the enemy do? If they do that, how can I respond? Will the outcomes be different if…

-

The Present Future of Audio: Talk, Music, Video, Interactivity – a16z Podcast

a16z podcast has had two very interesting episodes on the past, present and future of audio. This episode goes deeper into understanding the trends, why audio as a content format looks promising and some great insights into Spotify’s journey of launching podcasts within the same app. Here are my notes/summary of the episode. Understanding Audio…

-

How to find and keep True North | Susan Wojcicki – Masters of Scale

Serendipity Susan (YouTube CEO) was raised in the valley area as her dad taught at Stanford. She decides to not pursue her PhD but get an MBA instead. She gets married, buys a house and decides to rent it out to manage the mortgage better. A common friend connects her to a startup looking to…

-

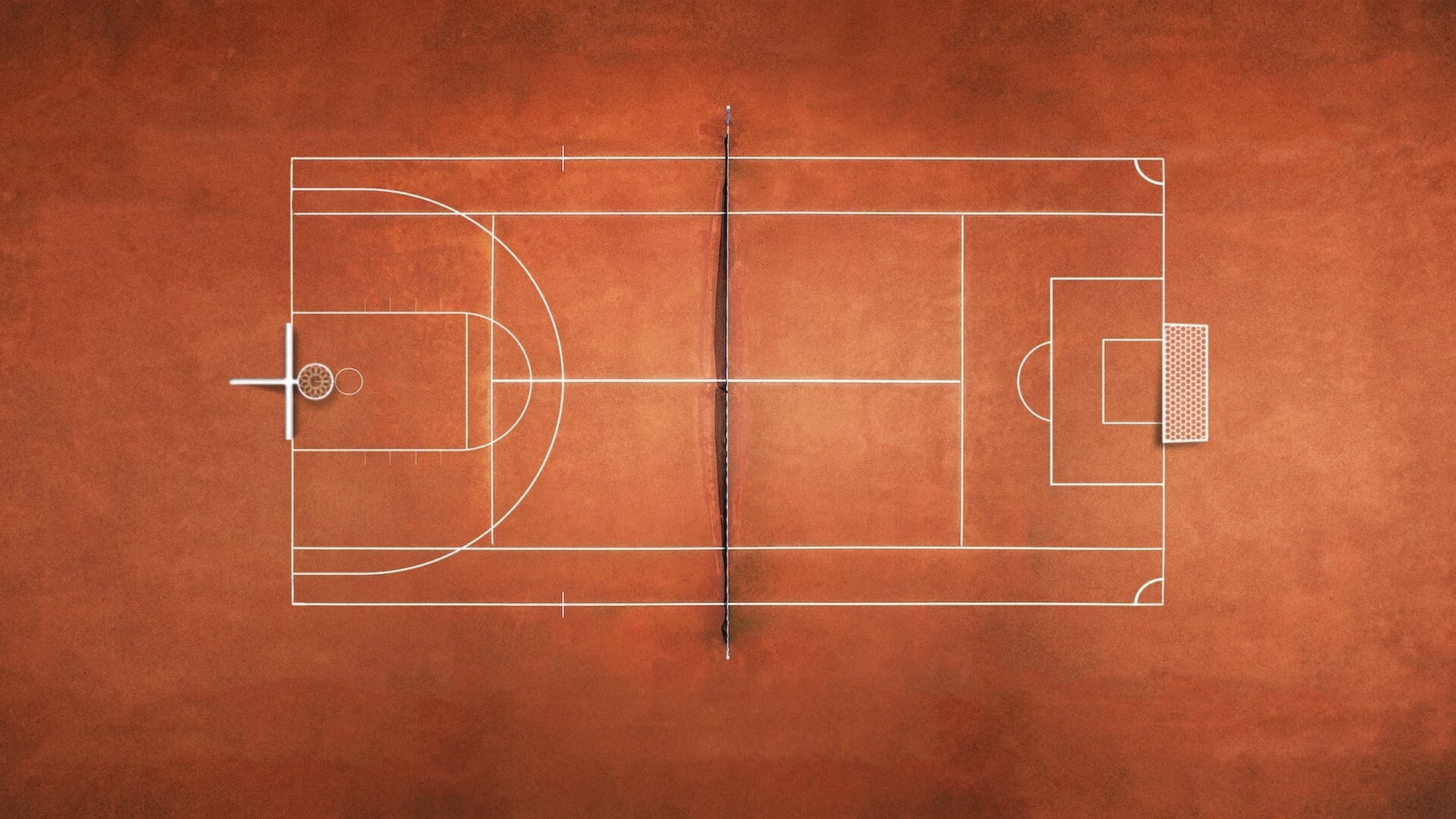

The Playbook – A coach’s rules for life

Sports has been a very important part of my life. While, I didn’t manage to reach a level that would allow me to play my chosen sport(s) even at the district level competitively. I did manage to learn a lot from sports. A lot ! For one, it taught me how to deal with failures.…

-

Masters of Search in the streaming era

Search Experience on Netflix, Amazon Prime and You Tube Across both audio and video formats, the online media consumption in our generation is higher than ever before. This growing consumption by an ever increasing base of consumers will also mean varied consumer journeys – i.e. how the content gets discovered and consumed may have multiple…

-

Understanding the power of gamification

For the last 2 weeks, I have been learning Spanish on Duolingo. It’s amazing. The Duolingo app is just phenomenally well designed for helping one go deeper into the world of a new language – one chapter/session at a time. Thanks to its regular in-between-session nudges I have been super regular. Built a 13 days…

-

Problem Framing and choice of adjectives – story of ventilators and sanitizers

Problem Framing is considered a crucial step in the development of a new solution/product or in problem solving. Yet, we miss spending enough quality time on this step, many a times. Disclaimer: I will be over-simplifying a few aspects, to drive home the key point so please humor me. Since early March, as the Corona…

-

Behavior Elasticity > Demand Elasticity. A quick Coffee Poll

Are you someone who used to drink a coffee (or two) everyday at the barista next to your office? If, yes spare a quick minute to tell us how WFH during COVID has impacted your coffee+work association. [poll id=”2″] [poll id=”3″] Read below on why this quick poll…. Let me explain why this quick poll.…

-

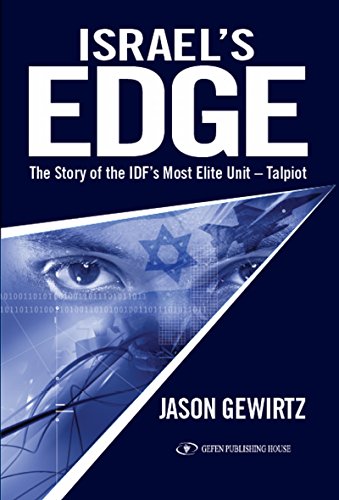

Talpiot – Israel’s super school for military tech – lessons in sustainable innovation

Talpiot – the Super School I have always wondered how has Israel, given its challenges, managed to position itself as a leader in cutting-edge military tech. And it seems the answer lied in the months and years that followed Yom Kippur War. Specifically the creation of the Talpiot Program within the IDF. I just chanced…

-

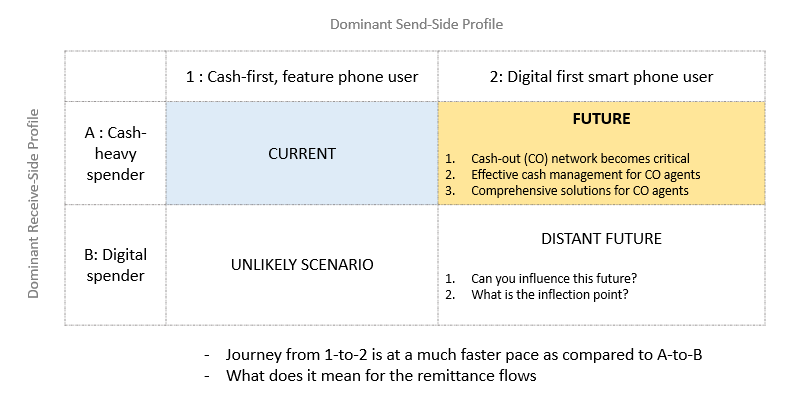

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

Find what’s really broken before fixing it

I enjoy coding. While I have a long way to go as a programmer, coding does put me in a zen kind of a state. The mix of learning and building something new, is almost magical. It does fuel and inspire the problem solver in me. And it is a great teacher too. I just…

-

A tale of two cards

“Building a visionary company requires one percent vision and 99 percent alignment.” —Jim Collins and Jerry Porras, Built to Last And I believe the alignment needs to show not in meetings but on the ground – in customer interactions, in every process and the decision making across all levels. A recent experience drove home the point very…

-

Factory and Lab mindsets in product management teams

Factories and laboratories evoke very different images. With a factory – I am usually thinking the industrial revolution in all its glory – machines, assembly lines, robots, workers, all working in a disciplined and predictable manner – churning out products that are all identical and meet the claimed specifications. Low room for error. Designed for…