Tag: Digital

-

Cash is not the enemy – Stickiness of Cash Part 1

Why is cash so sticky in our society? Many of us have argued for the need to build convenience, security and ubiquity for digital payments. And then cash would start receding. No debate there. But we forget that as individuals our brains are wired to go back to cues that are triggered at the sub-conscious…

-

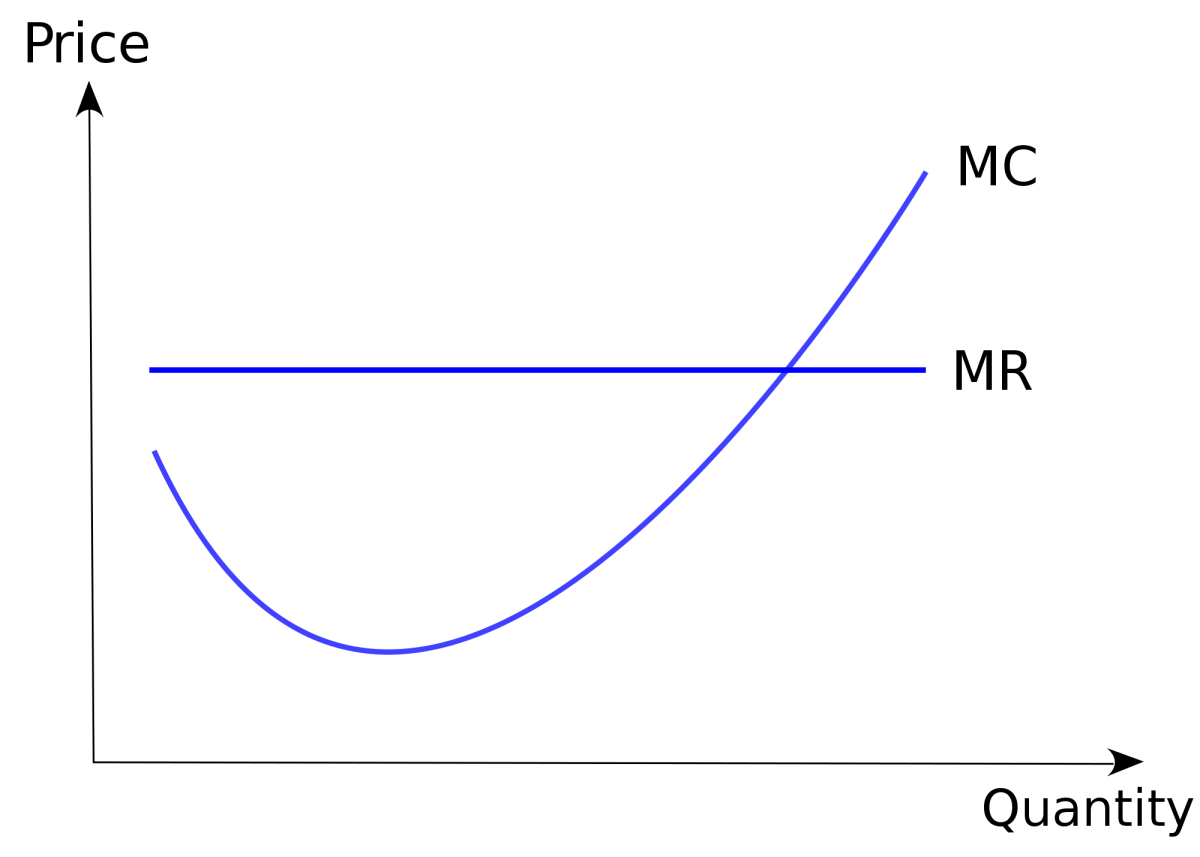

Unit Economics in the times of Auction Marketing Models

Unit Economics is all we hear these days in the consumer technology world. Unfortunately for many start-ups seeking venture funds, this is the biggest hurdle they need to cross to build a strong case for their business. What is the concept of Unit Economics I will not go into the definition and relevance of Unit…

-

3 tips for New To Bank Acquisitions – Digital Banking Toolkit

Why Online Acquisitions Acquiring New To Bank (NTB) customers is a key agenda for most Digital Heads at Banks. Its only logical that online acquisition budgets are getting bigger, given the following: Consumers are spending more and more time online. Digital is the best channel to start a dialogue Digital channels are tracked exhaustively. You…

-

Play to your strengths – Digital Banking Toolkit

Nadal is the king of clay. Given a choice of surface, I guess he would choose clay 9 out of 10. We all get it – one should play to one’s own strength. Its obvious in sports, but most of us fail to apply the same rule(s) in business. As most banks embrace digital, this…

-

Digital success needs a matured partnership mindset

I believe that smart matured digital players will need to develop deep partnerships. Let me explain why. With the growing consumption of digital media, there is considerable noise that a consumer is now exposed to. This would mean that the brands have a fast shrinking window of opportunity where they have their prospects attention. Most…

-

9 challenges in digitizing the sales force

Very few of us embrace change.Most of us would try our best to avoid any change in the status quo. Especially if it drastically impacts the way we work. Hence any initiative to convert an offline banking/insurance sales channel into a digitally-enabled online one, is sure to face a lot of resistance from the existing…