Tag: Design

-

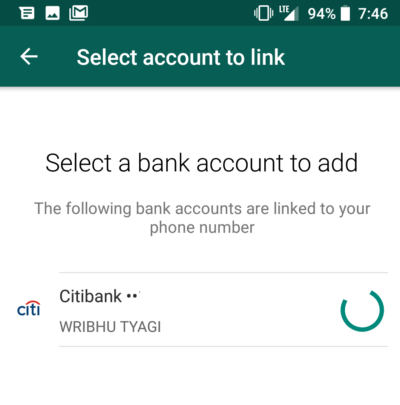

Quest for Friction Less Experiences

Yesterday, I got to experience the WhatsApp payment flows. It surely felt like a neat friction-less experience both for adding/mapping bank accounts and for in-chat payments. And in my excitement I forwarded it to a friend who didn’t have any UPI handle so far. And I was surprised by the reaction. How does WhatsApp know…

-

Good rules should be designed for higher adoption

How do we drive adoption for rules in a community, or even at a country level ? Should a good rule be designed to make it easily enforceable too? I think it should be. If we want to build a society where most follow the rules, enforceability should be an important criteria. To decide whether…

-

Why Financial Services Cos need Designers and fast !

I just came back from depositing a cheque into a relative’s HDFC Bank account. I know, its a crime that I did not use the Online Money Transfer services, especially since I am a self proclaimed Digital guy working in the Financial Services sector. Anyways, I was filling in the deposit slip with details of…

-

Enterprise solutions – designing around the customer

A recent experience with a telecom co. brought back memories from my Credit Card days. A customer issue is raised and gets escalated to the corporate team. The corporate team looks at the data (across systems) and decides to waive certain charges or settle the “issue”. Customer gets a promise from the manager at the…

-

German Engineering but definitely Chinese manufacturing

Todays Times of India (TOI) was a pleasant surprise for most readers. The lucky few were the ones to experience a nice innovation in advertising – something that brought together the print and audio media like never before. A full page Volkswagen ad had a small speaker with a recorded message about the German Engineering…