-

Embrace APIs – Digital Banking Toolkit

Digital is the latest buzzword in banking. Not only are the bank boardrooms echoing with digital keywords, its what seems to be driving the pitches at most IT and Management Consulting firms. And rightly so ! When the data tells us that 9% of the population already uses Mobile Banking, we know that Digital Banking…

-

Digital India – its already here

Today’s the launch of the Digital India initiative and quite a coincidence that I had an experience which makes me believe that Digital India is already here. Here’s what happened. I was in Mumbai and called for an Uber. I started talking to the cabbie to understand the target market for a specific use case…

-

Can someone ever be truly selfish

selfish (of a person, action, or motive) lacking consideration for other people; concerned chiefly with one’s own personal profit or pleasure. This definition is inherently flawed. Why? I can explain it in two steps: Very simple – I have come to believe that the only way any of us can get true happiness and peace…

-

Play to your strengths – Digital Banking Toolkit

Nadal is the king of clay. Given a choice of surface, I guess he would choose clay 9 out of 10. We all get it – one should play to one’s own strength. Its obvious in sports, but most of us fail to apply the same rule(s) in business. As most banks embrace digital, this…

-

Why do we sometimes go quiet during roadtrips?

Found this in my notes from a road trip taken almost 10 years back in Dec 2005. ——— In the last few months I have discovered a passion to travel, but what I havent learnt so far is why I love it? What gets me excited to just get out of “here” and be out…

-

Why is Financial Inclusion important?

Financial Inclusion is a common theme across multiple initiatives both by governments and private sectors across economies. Especially in the developing world, it would be safe to say that Financial Inclusion must be in the top 5 priorities of the respective governments. But why exactly is Financial Inclusion important ? Financial Inclusion takes an…

-

Digital success needs a matured partnership mindset

I believe that smart matured digital players will need to develop deep partnerships. Let me explain why. With the growing consumption of digital media, there is considerable noise that a consumer is now exposed to. This would mean that the brands have a fast shrinking window of opportunity where they have their prospects attention. Most…

-

Big Data, medicine and Dr Gregory House

I am a big fan of House. BIG FAN ! I guess what I really like is the infectious curiosity of Dr Gregory House and the very extreme personalities of the characters at this clinic. In my overly simplistic understanding of medicine, there are two parts to it – diagnosis and treatment. And our Dr…

-

Lessons from “David & Goliath” by Malcolm Gladwell

“David and Goliath – Underdogs, Misfits and the art of battling giants” is the new book from Malcolm Gladwell which is based on the premise that maybe we have all been looking at the David and Goliath story completely wrong. Gladwell starts by discussing specific details from the Biblical story to build the case that…

-

Why mobile payments must arrive soon

I try to go walking on most weekdays. And I prefer to do so light – carry just the minimal stuff. On my way out for a walk yesterday, I stopped by to take some cash along with me – just in case. And this got me thinking, with my smartphone (& earphones) I do not…

-

Crowdsourcing from a captive audience – New approach to complimentary breakfasts

Crowdsourcing is all the rage. And restaurants seem to have caught the fancy. There is this guy who is spending a good time just getting real feedback before he decides what and where of his restaurant. A few restaurants have decided to skip the printed menu completely. Who wants to pay professional photographers when the customers…

-

School for future politicians

I was super excited by the political experiments that were happening in the capital when Aam Aadmi Party was launched after the successful India-Against-Corruption movement. But my excitement didn’t last too long. Personally, I felt sad that the Kejriwal goverment decided to quit. As an observer and eternal optimist I was hoping that this experiment would…

-

Impact of un-utilized assets : A Mathematical Model

A few weeks back I was wondering what happens when we buy a car but don’t drive it. While the automobile industry witnesses a growth but is it something that increases the drag on the economy. I spent a few hours to work on a very simple model to find what happens in various consumption…

-

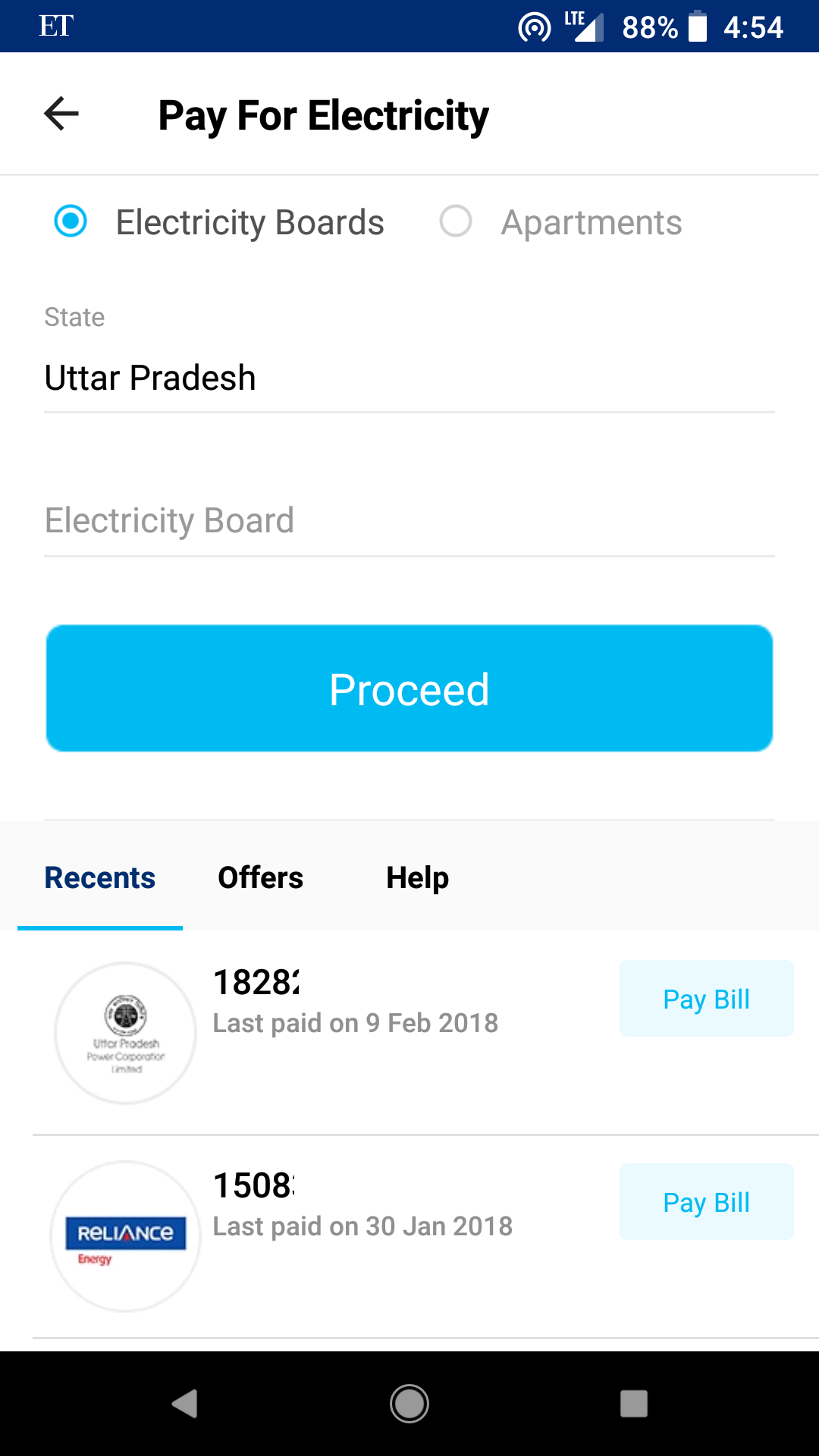

Why I use Paytm for all bill payments except Airtel

Consumer behavior used to be a course that marketing folks took in 2nd year of Bschool. I stayed away , like most other marketing courses. But over the years, time and again I have seen the importance of understanding the consumer behavior – why do consumers behave a specific way, why and how are habits formed,…

-

How to save the Boiling Frog?

We have all heard about the boiling frog phenomenon – Put a frog in boiling water and it would immediately jump out. Instead keep a frog in cold water and heat the water slowly, the frog would just boil to death. While I don’t know if this experiment was ever done or not (one guy actually…

-

Recommended feature for Google Maps Application

Gratitude First – I am really thankful for Google for the traffic layer on its Maps application. Like most others in Delhi, I have become a regular Google Maps user now, checking the traffic updates and choosing the route that I should take to reach my destination. So much so, that my driver also insists…