Category: Ideas

-

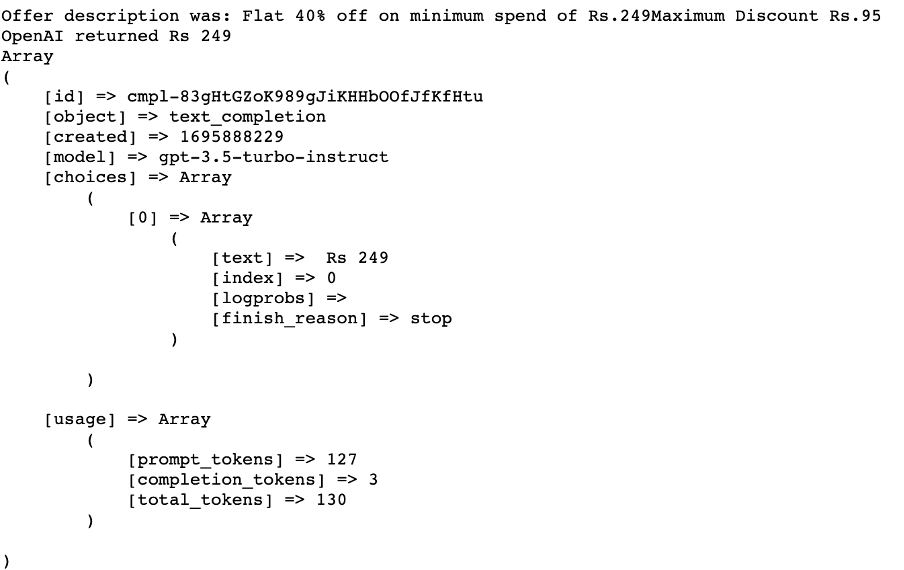

Using GenAI APIs to extract information from text

Spent half a day tinkering with GenAI (OpenAI) APIs to solve a real-world problem. Felt good to be coding after so many months. This was the 2nd attempt at understanding GenAI better with a real world problem statement. First one was this. The Problem Statement – Opportunity to deploy OpenAI At mTuzo we have collated…

-

Talpiot – Israel’s super school for military tech – lessons in sustainable innovation

Talpiot – the Super School I have always wondered how has Israel, given its challenges, managed to position itself as a leader in cutting-edge military tech. And it seems the answer lied in the months and years that followed Yom Kippur War. Specifically the creation of the Talpiot Program within the IDF. I just chanced…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…

-

Beyond Big Data – A Small and fast data example

Big Data is all the rage. Everywhere you go, any meeting or presentation one sits through, Big Data seems to be there. But there are opportunities beyond big data. E.g. how we handle small data fast. Here’s an example of small data that I experience almost everyday. In many corporate buildings in India, you would…

-

Good rules should be designed for higher adoption

How do we drive adoption for rules in a community, or even at a country level ? Should a good rule be designed to make it easily enforceable too? I think it should be. If we want to build a society where most follow the rules, enforceability should be an important criteria. To decide whether…

-

Showing Contact Addresses in Google Maps

Quick Summary: Here’s a small product feature recommendation for Google Maps on Android. Currently when I am in Google Maps and typing in the search box, it throws results that match with Google Places directory on the web. If it also throws matches with local contacts in the phone (or Google account) that have an…

-

Easier to be Krishna than to be Arjun

The other day, my mom shared a powerful and thought-provoking quote, that she had just read. It’s easier to be Krishna, than to be Arjun !! And she went on to explain, that being Krishna requires one to look inside and discover the highest qualities that each of us are bestowed with. But to be…

-

Digital India – its already here

Today’s the launch of the Digital India initiative and quite a coincidence that I had an experience which makes me believe that Digital India is already here. Here’s what happened. I was in Mumbai and called for an Uber. I started talking to the cabbie to understand the target market for a specific use case…

-

Play to your strengths – Digital Banking Toolkit

Nadal is the king of clay. Given a choice of surface, I guess he would choose clay 9 out of 10. We all get it – one should play to one’s own strength. Its obvious in sports, but most of us fail to apply the same rule(s) in business. As most banks embrace digital, this…

-

Crowdsourcing from a captive audience – New approach to complimentary breakfasts

Crowdsourcing is all the rage. And restaurants seem to have caught the fancy. There is this guy who is spending a good time just getting real feedback before he decides what and where of his restaurant. A few restaurants have decided to skip the printed menu completely. Who wants to pay professional photographers when the customers…

-

School for future politicians

I was super excited by the political experiments that were happening in the capital when Aam Aadmi Party was launched after the successful India-Against-Corruption movement. But my excitement didn’t last too long. Personally, I felt sad that the Kejriwal goverment decided to quit. As an observer and eternal optimist I was hoping that this experiment would…

-

Recommended feature for Google Maps Application

Gratitude First – I am really thankful for Google for the traffic layer on its Maps application. Like most others in Delhi, I have become a regular Google Maps user now, checking the traffic updates and choosing the route that I should take to reach my destination. So much so, that my driver also insists…