Category: Leadership

-

Filter by Scale, Sort by Velocity – Building Momentum

For most organizations (startup or otherwise) building momentum might be the #1 goal. Increasing momentum on revenues, margins, customers, transactions, data-footprint etc etc. A big part of it comes down to choosing which opportunities to go after and which one’s to drop (even if for now). Of course there are multiple other factors too –…

-

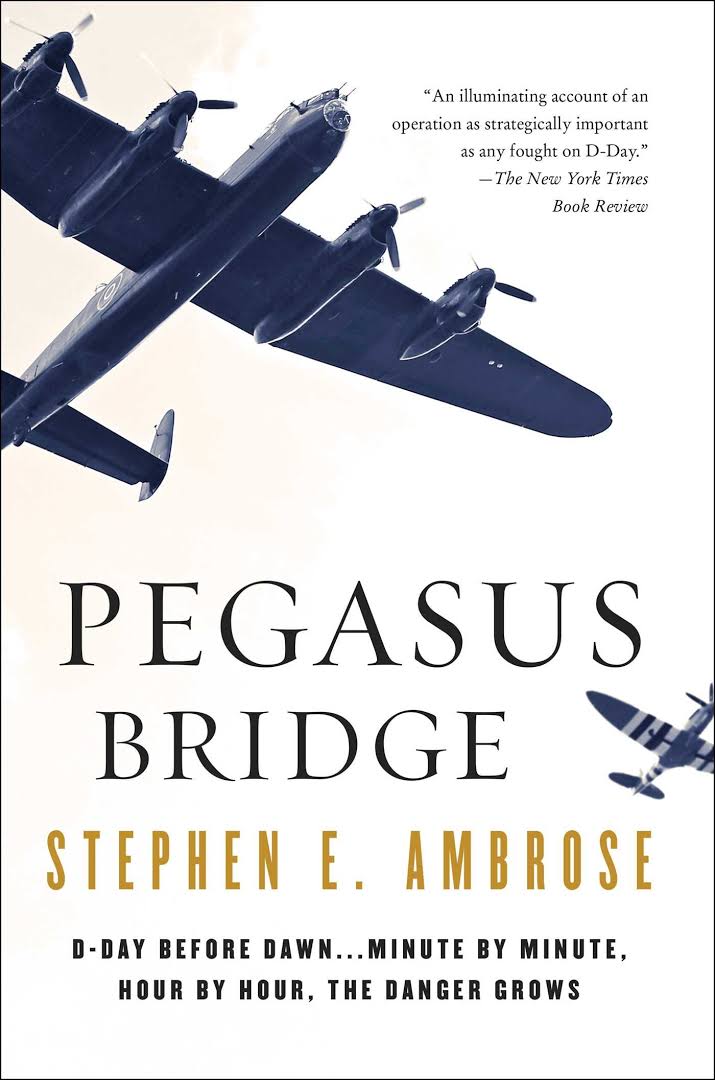

Game Theory, No-Regret Plans and the role of Iceland in World War II

Game Theory and understanding options available Game theory provides a strong framework for strategic options in a dual player game. Options available both to self and the other player(s). E.g. When you are in a war. What would the enemy do? If they do that, how can I respond? Will the outcomes be different if…

-

How to find and keep True North | Susan Wojcicki – Masters of Scale

Serendipity Susan (YouTube CEO) was raised in the valley area as her dad taught at Stanford. She decides to not pursue her PhD but get an MBA instead. She gets married, buys a house and decides to rent it out to manage the mortgage better. A common friend connects her to a startup looking to…

-

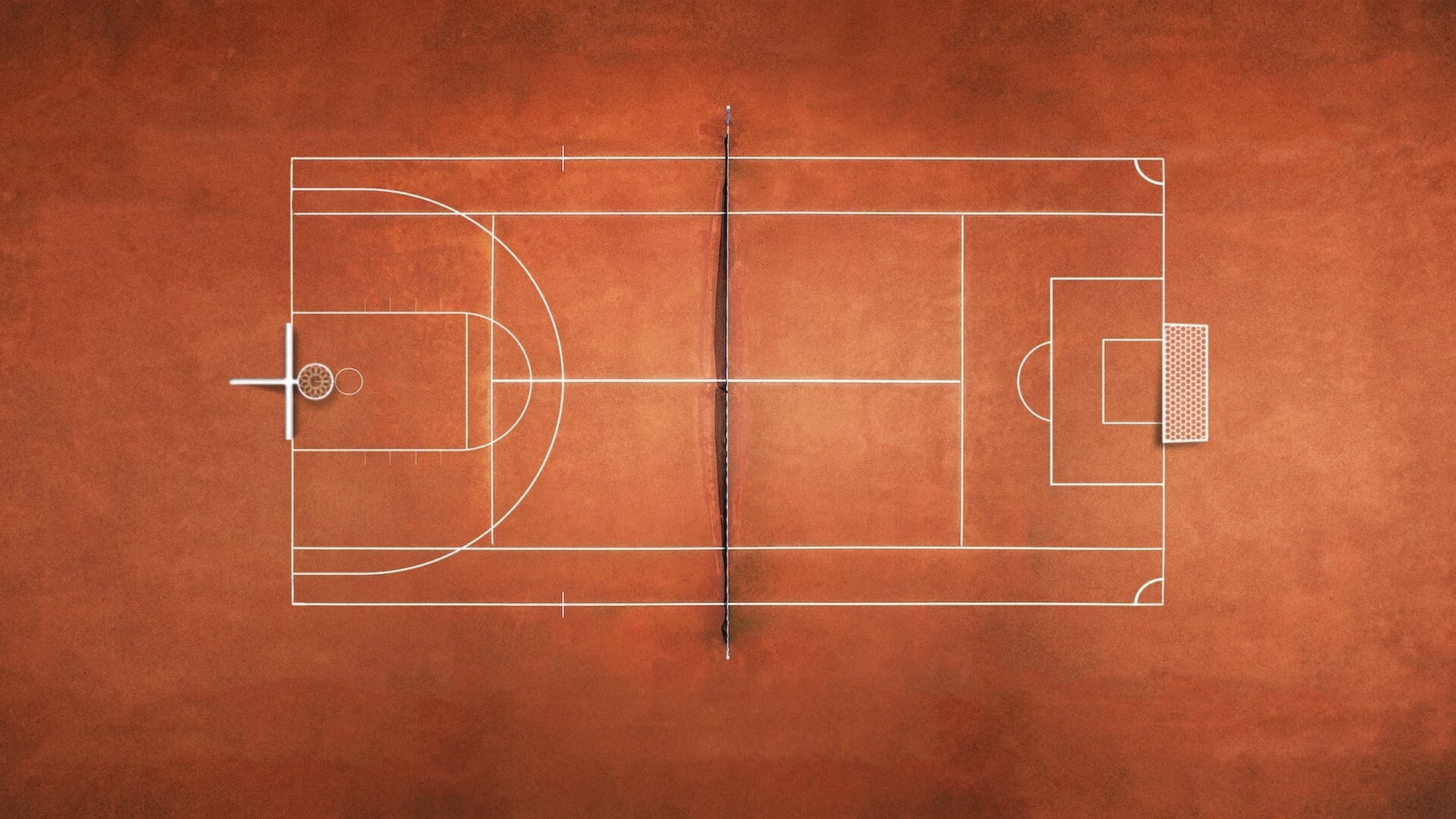

The Playbook – A coach’s rules for life

Sports has been a very important part of my life. While, I didn’t manage to reach a level that would allow me to play my chosen sport(s) even at the district level competitively. I did manage to learn a lot from sports. A lot ! For one, it taught me how to deal with failures.…

-

Problem Framing and choice of adjectives – story of ventilators and sanitizers

Problem Framing is considered a crucial step in the development of a new solution/product or in problem solving. Yet, we miss spending enough quality time on this step, many a times. Disclaimer: I will be over-simplifying a few aspects, to drive home the key point so please humor me. Since early March, as the Corona…

-

Find what’s really broken before fixing it

I enjoy coding. While I have a long way to go as a programmer, coding does put me in a zen kind of a state. The mix of learning and building something new, is almost magical. It does fuel and inspire the problem solver in me. And it is a great teacher too. I just…

-

Factory and Lab mindsets in product management teams

Factories and laboratories evoke very different images. With a factory – I am usually thinking the industrial revolution in all its glory – machines, assembly lines, robots, workers, all working in a disciplined and predictable manner – churning out products that are all identical and meet the claimed specifications. Low room for error. Designed for…

-

Why so serious ! Need for humor at work

This happened yesterday – We settled down for a discussion first thing in the morning and a colleague says- smile guys, its a good day! But, it was a spirited discussion . And the smiles quickly vanished. We shared our views and debated. And I realised I was talking with a lot of emotional energy. I told myself,…

-

Good rules should be designed for higher adoption

How do we drive adoption for rules in a community, or even at a country level ? Should a good rule be designed to make it easily enforceable too? I think it should be. If we want to build a society where most follow the rules, enforceability should be an important criteria. To decide whether…

-

Public policy, ripple effects and feedback loops

I have always been intrigued by product design and by extension policy design (& implementation). If the government were to look at itself as a start-up technology venture, the policies, schemes and guidelines issued by the government would possibly be the “products” of this venture. And like any good product manager, one should study not…

-

3 tips for New To Bank Acquisitions – Digital Banking Toolkit

Why Online Acquisitions Acquiring New To Bank (NTB) customers is a key agenda for most Digital Heads at Banks. Its only logical that online acquisition budgets are getting bigger, given the following: Consumers are spending more and more time online. Digital is the best channel to start a dialogue Digital channels are tracked exhaustively. You…

-

Easier to be Krishna than to be Arjun

The other day, my mom shared a powerful and thought-provoking quote, that she had just read. It’s easier to be Krishna, than to be Arjun !! And she went on to explain, that being Krishna requires one to look inside and discover the highest qualities that each of us are bestowed with. But to be…

-

Embrace APIs – Digital Banking Toolkit

Digital is the latest buzzword in banking. Not only are the bank boardrooms echoing with digital keywords, its what seems to be driving the pitches at most IT and Management Consulting firms. And rightly so ! When the data tells us that 9% of the population already uses Mobile Banking, we know that Digital Banking…

-

Play to your strengths – Digital Banking Toolkit

Nadal is the king of clay. Given a choice of surface, I guess he would choose clay 9 out of 10. We all get it – one should play to one’s own strength. Its obvious in sports, but most of us fail to apply the same rule(s) in business. As most banks embrace digital, this…

-

How to save the Boiling Frog?

We have all heard about the boiling frog phenomenon – Put a frog in boiling water and it would immediately jump out. Instead keep a frog in cold water and heat the water slowly, the frog would just boil to death. While I don’t know if this experiment was ever done or not (one guy actually…

-

Simplest way to build trust and confidence

Many a times, we face a situation where we feel that our team members do not have trust and confidence in us or each other. Whether its a corporate set-up or the political leadership of a country or a sporting team, trust and confidence are the key ingredients for a motivated spirited performance. And I…

-

Leadership Lessons from Making of India – Book by Ranbir Vohra

It was quite some time back that I read the book – Making of India – by Ranbir Vohra. This was December 2006 and I had a habit of taking notes from any book that I read. Sometimes even movies. So what you read below are my interpretations of the historical narration of India’s journey…

-

CEOs role as friction buster

Not so long ago, a Private Equity guy told me that I was trying to do too many things as the CEO. Initially I thought he meant that I should hire more people and let them manage the daily operations. While that was there, but what he went on to mention could probably be summarized…