Tag: Payments

-

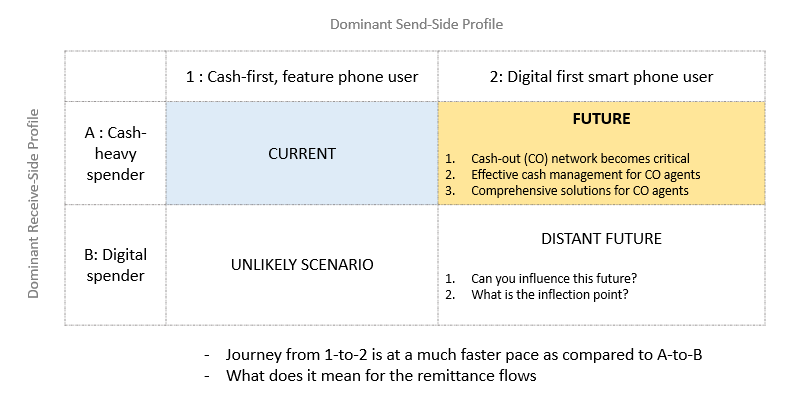

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

Cash is not the enemy – Stickiness of Cash Part 1

Why is cash so sticky in our society? Many of us have argued for the need to build convenience, security and ubiquity for digital payments. And then cash would start receding. No debate there. But we forget that as individuals our brains are wired to go back to cues that are triggered at the sub-conscious…

-

The real eCommerce revolution

Had an interesting conversation with an investor friend yesterday, who is really active in the start-up/seed stage. We were talking about the many niche plays that are coming up with the well funded steep growth we are witnessing in the ecommerce industry. While there is no doubt, that Indians have started buying/shopping/ordering online and in…

-

Exciting future for payments

Had an interesting conversation over the weekend with the office caretaker- a young late 20’s chap who has his wife and kids back home in Nepal. He told me very excitedly how he managed to send across money to them in Nepal through a new option wherein the credit was showing in his Nepalese account…