Tag: Consumer Behavior

-

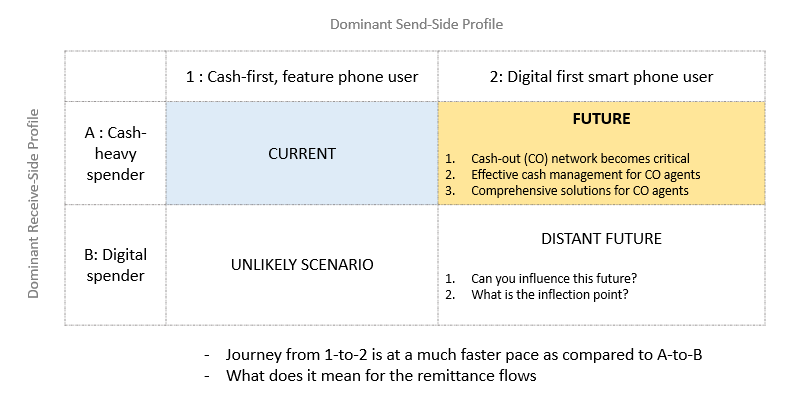

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

Uber and Free Market Economics

Uber has changed the way we travel within cities. On a recent trip to Jaipur, the first thing I did on reaching the city, was to top-up my PayTm wallet to get going on Uber. (yeah no card-on-file yet 🙂 ) And over the next 3 days I took more than 12 rides across the…

-

How much should we pay

Amazing little discussion today, which brought forth the consumer perception about pricing. A guy walks upto the apartment across the road & offers to remove the bee-nest. He gets the job for a small sum of money (not sure how much) and the deal says, he will get to keep the honey also. He comes…