Category: Financial Inclusion

-

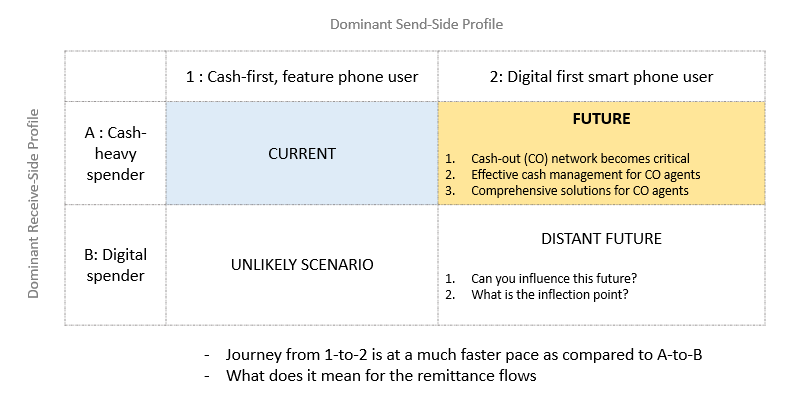

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…

-

Why is Financial Inclusion important?

Financial Inclusion is a common theme across multiple initiatives both by governments and private sectors across economies. Especially in the developing world, it would be safe to say that Financial Inclusion must be in the top 5 priorities of the respective governments. But why exactly is Financial Inclusion important ? Financial Inclusion takes an…