Tag: Economics

-

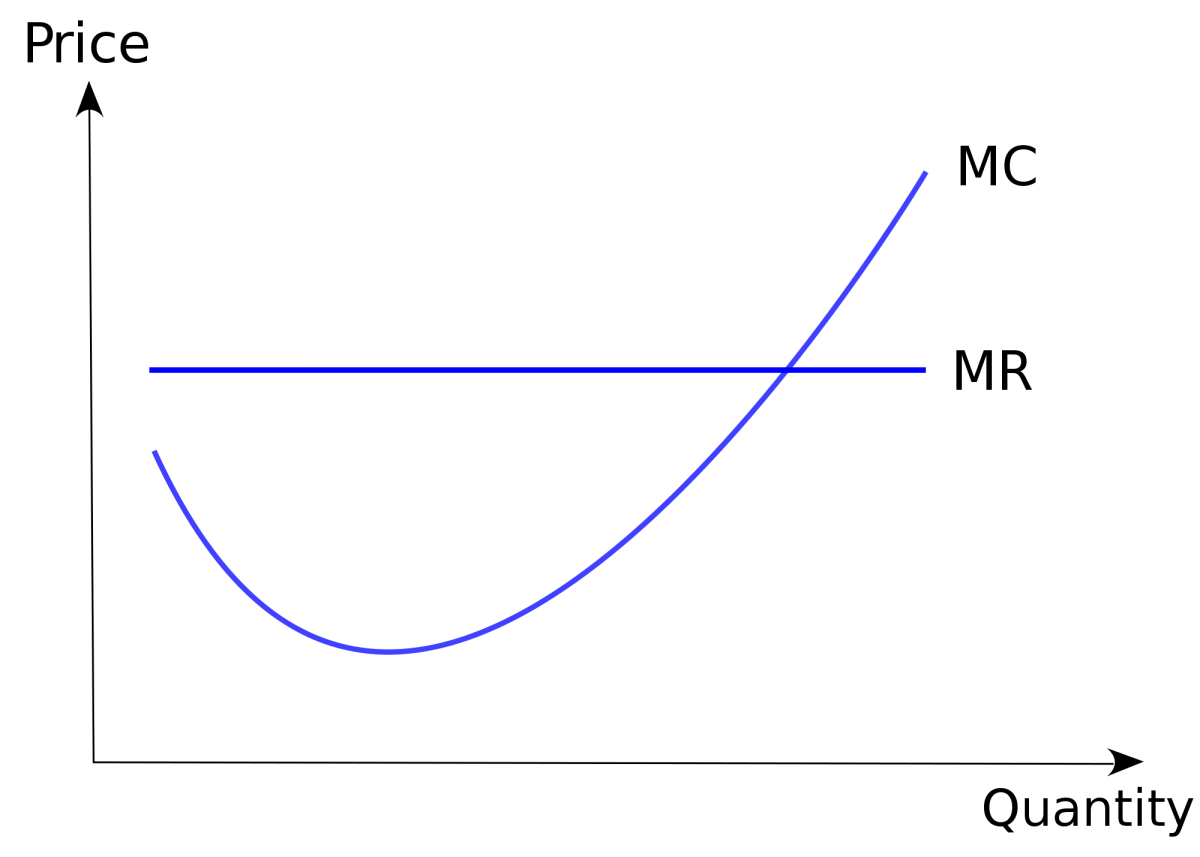

Unit Economics in the times of Auction Marketing Models

Unit Economics is all we hear these days in the consumer technology world. Unfortunately for many start-ups seeking venture funds, this is the biggest hurdle they need to cross to build a strong case for their business. What is the concept of Unit Economics I will not go into the definition and relevance of Unit…

-

Uber and Free Market Economics

Uber has changed the way we travel within cities. On a recent trip to Jaipur, the first thing I did on reaching the city, was to top-up my PayTm wallet to get going on Uber. (yeah no card-on-file yet 🙂 ) And over the next 3 days I took more than 12 rides across the…

-

Impact of un-utilized assets : A Mathematical Model

A few weeks back I was wondering what happens when we buy a car but don’t drive it. While the automobile industry witnesses a growth but is it something that increases the drag on the economy. I spent a few hours to work on a very simple model to find what happens in various consumption…