Tag: UX

-

Quest for Friction Less Experiences

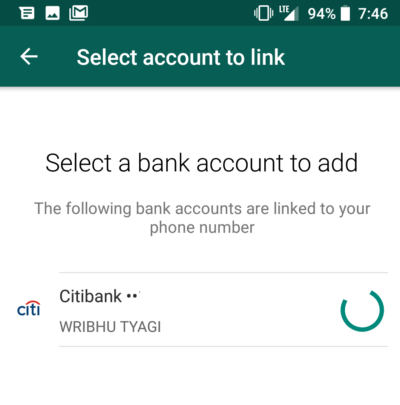

Yesterday, I got to experience the WhatsApp payment flows. It surely felt like a neat friction-less experience both for adding/mapping bank accounts and for in-chat payments. And in my excitement I forwarded it to a friend who didn’t have any UPI handle so far. And I was surprised by the reaction. How does WhatsApp know…

-

Why Financial Services Cos need Designers and fast !

I just came back from depositing a cheque into a relative’s HDFC Bank account. I know, its a crime that I did not use the Online Money Transfer services, especially since I am a self proclaimed Digital guy working in the Financial Services sector. Anyways, I was filling in the deposit slip with details of…