Tag: digital payments

-

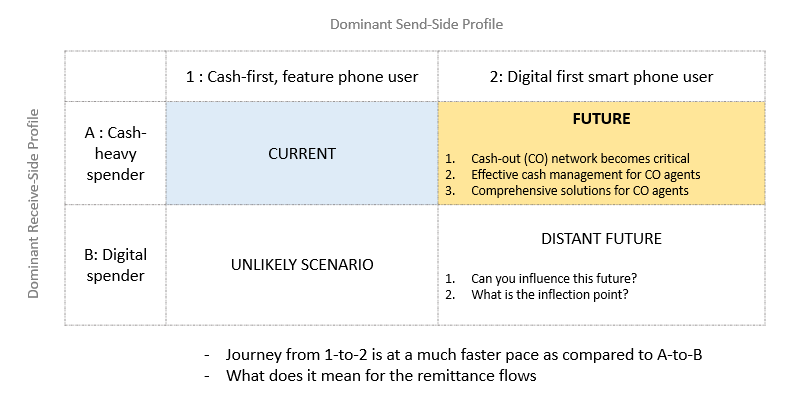

Varying rates of digital adoption across send and receive-sides impact payment-flows

Very simplistically put, payment is the movement of money from A to B. And the world is becoming increasingly comfortable with money flow going digital. Whether its a consumer paying another consumer (P2P) or consumer paying a merchant (P2M) or business paying its vendors/suppliers (B2B) – the levels of digitization of these use-cases is very…

-

A tale of two cards

“Building a visionary company requires one percent vision and 99 percent alignment.” —Jim Collins and Jerry Porras, Built to Last And I believe the alignment needs to show not in meetings but on the ground – in customer interactions, in every process and the decision making across all levels. A recent experience drove home the point very…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…