Category: Consumer Behaviour

-

The Present Future of Audio: Talk, Music, Video, Interactivity – a16z Podcast

a16z podcast has had two very interesting episodes on the past, present and future of audio. This episode goes deeper into understanding the trends, why audio as a content format looks promising and some great insights into Spotify’s journey of launching podcasts within the same app. Here are my notes/summary of the episode. Understanding Audio…

-

Masters of Search in the streaming era

Search Experience on Netflix, Amazon Prime and You Tube Across both audio and video formats, the online media consumption in our generation is higher than ever before. This growing consumption by an ever increasing base of consumers will also mean varied consumer journeys – i.e. how the content gets discovered and consumed may have multiple…

-

Understanding the power of gamification

For the last 2 weeks, I have been learning Spanish on Duolingo. It’s amazing. The Duolingo app is just phenomenally well designed for helping one go deeper into the world of a new language – one chapter/session at a time. Thanks to its regular in-between-session nudges I have been super regular. Built a 13 days…

-

Behavior Elasticity > Demand Elasticity. A quick Coffee Poll

Are you someone who used to drink a coffee (or two) everyday at the barista next to your office? If, yes spare a quick minute to tell us how WFH during COVID has impacted your coffee+work association. [poll id=”2″] [poll id=”3″] Read below on why this quick poll…. Let me explain why this quick poll.…

-

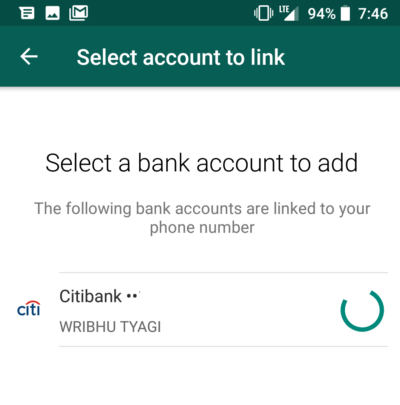

Quest for Friction Less Experiences

Yesterday, I got to experience the WhatsApp payment flows. It surely felt like a neat friction-less experience both for adding/mapping bank accounts and for in-chat payments. And in my excitement I forwarded it to a friend who didn’t have any UPI handle so far. And I was surprised by the reaction. How does WhatsApp know…

-

Migrating away from cash is intimidating – Stickiness of Cash Part 2

Ask any payment professional, and while they might disagree on what’s the best payment experience, they would all agree that Cash is sticky. And one of the core reasons for the stickiness of cash is that the migration journey is intimidating for most cash-heavy users. Too many choices Here are some of the many questions…

-

Cash is not the enemy – Stickiness of Cash Part 1

Why is cash so sticky in our society? Many of us have argued for the need to build convenience, security and ubiquity for digital payments. And then cash would start receding. No debate there. But we forget that as individuals our brains are wired to go back to cues that are triggered at the sub-conscious…

-

Public policy, ripple effects and feedback loops

I have always been intrigued by product design and by extension policy design (& implementation). If the government were to look at itself as a start-up technology venture, the policies, schemes and guidelines issued by the government would possibly be the “products” of this venture. And like any good product manager, one should study not…

-

Marshmallow Test and Insurance Marketing

I spent the last week reading up “The Marshmallow Test by Walter Mischel”. And while the book is a fascinating summary of key findings (and some of its applications) from Walters more than three decades of research, I found some of it is relevant for how we look at Insurance Marketing and Sales. What is…

-

SMS is reborn as an acqui channel in the Smartphone age

In the early days of Deal4Loans, we used to get a lot of traffic and leads through SMS campaigns. Especially for products like Personal Loans (Simple pitch and high-urgency in a need based product) During those days, NDNC (National DO NOT CALL) list was not introduced and there were very few players who were sending…

-

3 tips for New To Bank Acquisitions – Digital Banking Toolkit

Why Online Acquisitions Acquiring New To Bank (NTB) customers is a key agenda for most Digital Heads at Banks. Its only logical that online acquisition budgets are getting bigger, given the following: Consumers are spending more and more time online. Digital is the best channel to start a dialogue Digital channels are tracked exhaustively. You…

-

Uber and Free Market Economics

Uber has changed the way we travel within cities. On a recent trip to Jaipur, the first thing I did on reaching the city, was to top-up my PayTm wallet to get going on Uber. (yeah no card-on-file yet 🙂 ) And over the next 3 days I took more than 12 rides across the…

-

Digital India – its already here

Today’s the launch of the Digital India initiative and quite a coincidence that I had an experience which makes me believe that Digital India is already here. Here’s what happened. I was in Mumbai and called for an Uber. I started talking to the cabbie to understand the target market for a specific use case…

-

Can someone ever be truly selfish

selfish (of a person, action, or motive) lacking consideration for other people; concerned chiefly with one’s own personal profit or pleasure. This definition is inherently flawed. Why? I can explain it in two steps: Very simple – I have come to believe that the only way any of us can get true happiness and peace…

-

Lessons from “David & Goliath” by Malcolm Gladwell

“David and Goliath – Underdogs, Misfits and the art of battling giants” is the new book from Malcolm Gladwell which is based on the premise that maybe we have all been looking at the David and Goliath story completely wrong. Gladwell starts by discussing specific details from the Biblical story to build the case that…

-

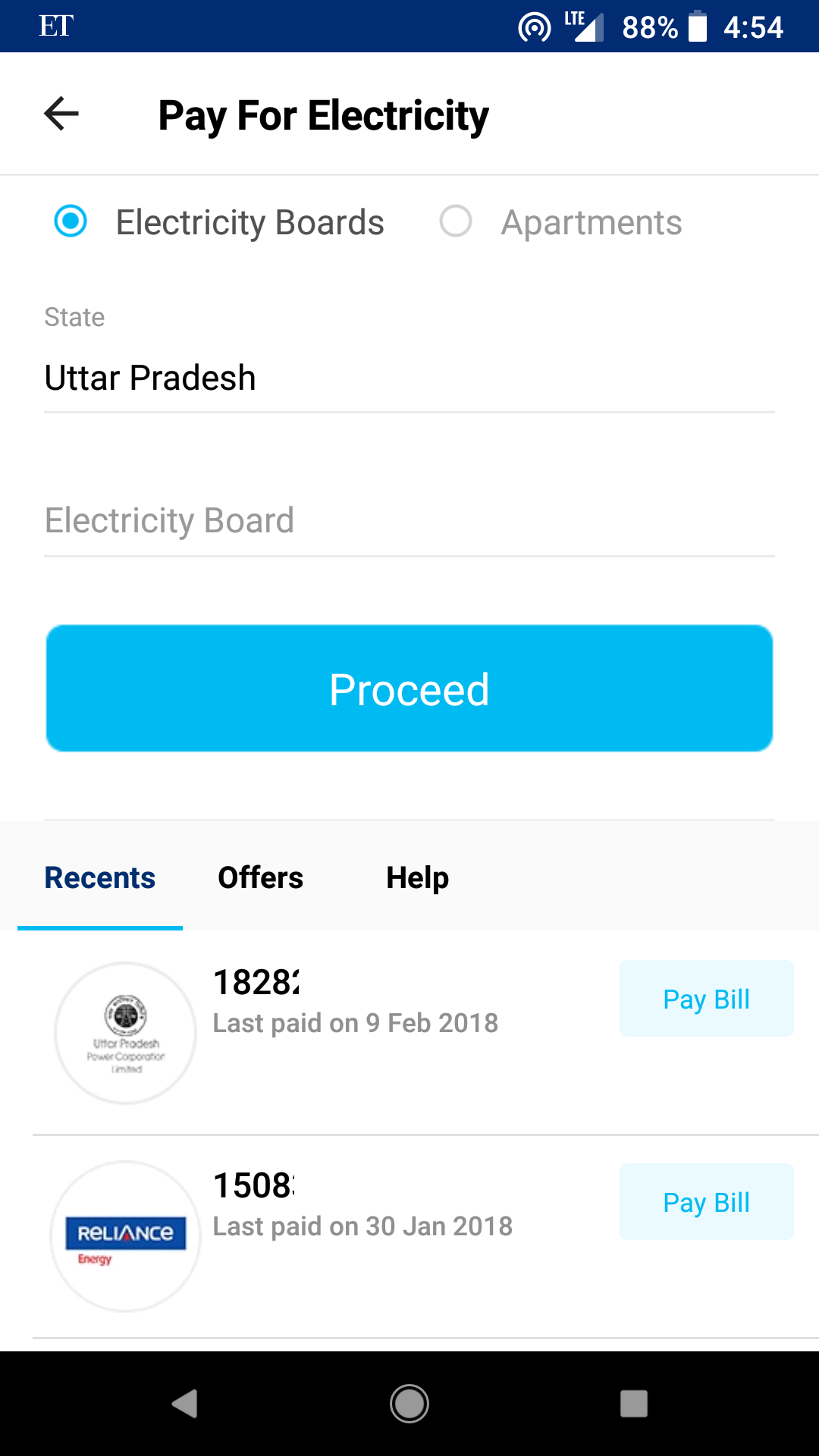

Why I use Paytm for all bill payments except Airtel

Consumer behavior used to be a course that marketing folks took in 2nd year of Bschool. I stayed away , like most other marketing courses. But over the years, time and again I have seen the importance of understanding the consumer behavior – why do consumers behave a specific way, why and how are habits formed,…