Category: Digital

-

Embrace APIs – Digital Banking Toolkit

Digital is the latest buzzword in banking. Not only are the bank boardrooms echoing with digital keywords, its what seems to be driving the pitches at most IT and Management Consulting firms. And rightly so ! When the data tells us that 9% of the population already uses Mobile Banking, we know that Digital Banking…

-

Digital India – its already here

Today’s the launch of the Digital India initiative and quite a coincidence that I had an experience which makes me believe that Digital India is already here. Here’s what happened. I was in Mumbai and called for an Uber. I started talking to the cabbie to understand the target market for a specific use case…

-

Play to your strengths – Digital Banking Toolkit

Nadal is the king of clay. Given a choice of surface, I guess he would choose clay 9 out of 10. We all get it – one should play to one’s own strength. Its obvious in sports, but most of us fail to apply the same rule(s) in business. As most banks embrace digital, this…

-

Why is Financial Inclusion important?

Financial Inclusion is a common theme across multiple initiatives both by governments and private sectors across economies. Especially in the developing world, it would be safe to say that Financial Inclusion must be in the top 5 priorities of the respective governments. But why exactly is Financial Inclusion important ? Financial Inclusion takes an…

-

Digital success needs a matured partnership mindset

I believe that smart matured digital players will need to develop deep partnerships. Let me explain why. With the growing consumption of digital media, there is considerable noise that a consumer is now exposed to. This would mean that the brands have a fast shrinking window of opportunity where they have their prospects attention. Most…

-

Why mobile payments must arrive soon

I try to go walking on most weekdays. And I prefer to do so light – carry just the minimal stuff. On my way out for a walk yesterday, I stopped by to take some cash along with me – just in case. And this got me thinking, with my smartphone (& earphones) I do not…

-

Crowdsourcing from a captive audience – New approach to complimentary breakfasts

Crowdsourcing is all the rage. And restaurants seem to have caught the fancy. There is this guy who is spending a good time just getting real feedback before he decides what and where of his restaurant. A few restaurants have decided to skip the printed menu completely. Who wants to pay professional photographers when the customers…

-

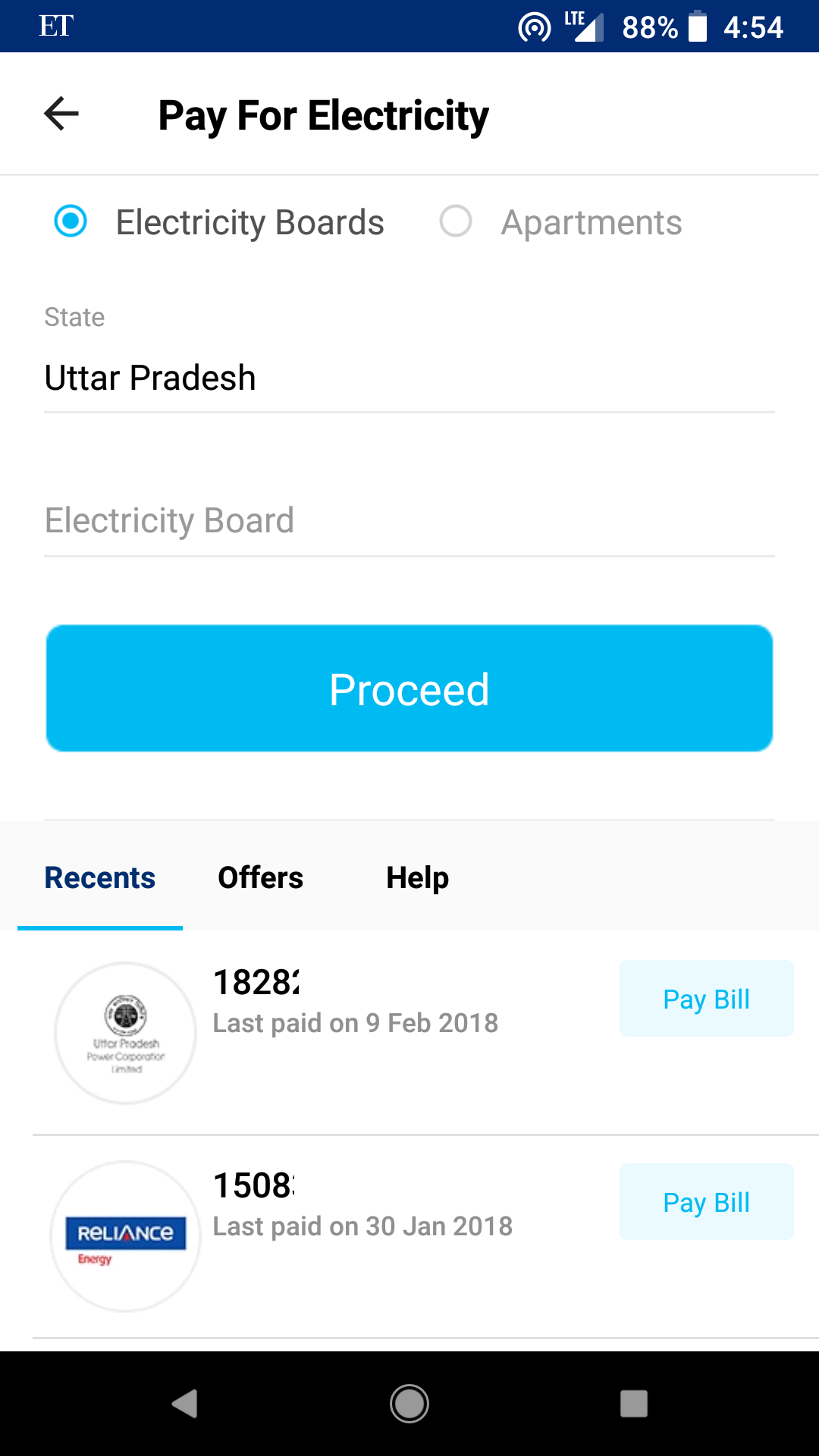

Why I use Paytm for all bill payments except Airtel

Consumer behavior used to be a course that marketing folks took in 2nd year of Bschool. I stayed away , like most other marketing courses. But over the years, time and again I have seen the importance of understanding the consumer behavior – why do consumers behave a specific way, why and how are habits formed,…

-

Recommended feature for Google Maps Application

Gratitude First – I am really thankful for Google for the traffic layer on its Maps application. Like most others in Delhi, I have become a regular Google Maps user now, checking the traffic updates and choosing the route that I should take to reach my destination. So much so, that my driver also insists…

-

Prediction comes true – In-site search market heating up

Not so long ago, I had written a blog post on why Bing should focus on in-site search as a way to fight Google’s stranglehold on the search space. While no one at Bing or Google heard me out on this, Techcrunch now reports on how this space is heating up. Two start-ups have already…

-

Why Financial Services Cos need Designers and fast !

I just came back from depositing a cheque into a relative’s HDFC Bank account. I know, its a crime that I did not use the Online Money Transfer services, especially since I am a self proclaimed Digital guy working in the Financial Services sector. Anyways, I was filling in the deposit slip with details of…

-

9 challenges in digitizing the sales force

Very few of us embrace change.Most of us would try our best to avoid any change in the status quo. Especially if it drastically impacts the way we work. Hence any initiative to convert an offline banking/insurance sales channel into a digitally-enabled online one, is sure to face a lot of resistance from the existing…

-

The curious case of single order and multiple delivery consignments @ Flipkart

This just happened to me again in a short span of time. I ordered 4/5 books from Flipkart and the ordered was split into multiple consignments and the two consignments were delivered within one day of each other. Initially I thought this was because the books might have been shipped from different warehouses or even…

-

HDFC Life’s Campaign to protect you from the rains

A colleague recounted an amazing experience she had at the Delhi Airport a few days back. She had just flown in and was waiting for her car. There is this small stretch at the Delhi airport that you need to cross from the covered porch of the terminal, to the waiting-car-lanes. While the stretch is…

-

Who owns the customer experience

I have been a regular and very loyal customer of Flipkart. They have a neat UI, collection is great, prices are good and they manage deliveries very well. While shopping for books last week I was shown a recommendation for “The Chariots of the Gods” a book whose introduction/teaser looked exciting. Needless to say I…

-

CSE – Custom Search Engine – Bing’s Opportunity

Recently Microsoft shared some UK market specific data, wherein they highlighted how Bing has managed to gain traction and bring Google’s share of the pie below the 90% mark. One can only begin to imagine the kind of uphill task Bing product and sales teams must be looking at. But, its also a time for…